Russia, Ukraine and the Markets

Editor’s note: Pittsburgh Quarterly recently asked regional financial experts to respond to the following question: The Russian invasion of Ukraine has further increased energy and food prices and disrupted supply lines for key manufacturing inputs. What are the implications for the global and U.S. economies?

James Armstrong, Henry Armstrong Associates

Free and open trade have proven beneficial to the economy on a global scale, and have held inflation down. The Russian invasion of Ukraine moves free trade backward. Inflationary pressures brought about by shortages of supply, rather than accelerated demand, are hard to control through monetary policy. We have a history of fighting inflation through tightening monetary policy, which can reduce demand, thereby helping to control prices. However, tighter monetary policy does not repair supply chains or replace shortages of supplies. The Russian war in Ukraine could be quite damaging economically.

George Mateyo, Key Private Bank

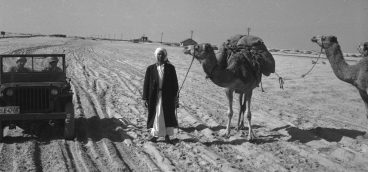

Assuming war lingers on, the most likely scenario is that inflationary pressures persist and growth slows. What this would mean is that Europe may tip into a recession, and growth in the U.S. would cool. Even if war ends relatively soon, the planting season in Ukraine is already at risk and commodities will continue to take a hit. Sadly, there are still only tanks in the fields, not tractors.

Michael R. Foster, J.P. Morgan Private Bank

Higher food and energy costs will be a hit to the consumer, but won’t be enough to singlehandedly push the economies of the U.S. and Europe into recession. However, these issues are likely to induce a notable slowdown. Across both the U.S. and Europe, consumer balance sheets are robust, debt servicing costs are low, corporate margins are still near records high, and earnings revisions are trending higher, not lower, therefore the backdrop remains fundamentally healthy. Notably we expect less impact in the U.S. due to lower exposure to imported energy and higher household savings. In an effort to combat inflation, the Fed is already tightening financial conditions. Adding in the growth risks from the war in Ukraine, the prospect of easy navigation by the Fed has gone down in our view. Our base case is that they will likely be able to control inflation by slowing demand amid the turbulence, but the margin for error is low, and our GDP estimates are lower. Putting it all together, we have lowered our 2022 GDP growth estimate from 4% to 3.1% in the U.S, and 4% to 2.7% in Europe. With humility about what we can project, the war introduces modestly higher inflationary pressures, while restricting growth; the effects are larger for Europe, not to mention the energy embargo risk.

Matthew George, PNC Financial Services

Inflation across OECD nations is at the highest level in forty years, as a result of supply chain bottlenecks caused by pandemic lockdown policies. Another factor has been the low energy stockpiles across Europe and Japan, pressuring oil and natural gas prices higher as winter heating season began. The Russian invasion into Ukraine just compounds these issues at a much larger scale.

Europe and Japan import 60% and 90% of their energy needs, respectively, and as energy prices remain elevated we expect earnings growth and profit margins to decline in those regions. We’ve already seen a sharp drop in consumer confidence surveys across Europe, which in the past has signaled economic activity could slow. If demand in Europe and Japan declines because of rising food and energy costs, it would have negative implications in the U.S. as well as emerging markets like China.

Another supply chain outside of food and energy that we’re watching is semiconductors. Ukraine is one of the largest manufacturers of neon, a key component in a number of different chips. We don’t see neon supplies being disrupted, but the semiconductor industry is already in a very delicate position of slowly normalizing production that any hiccups at this point would become yet another headwind for global supply chains.

Thomas Wentling, The WTL Group, Morgan Stanley

Energy, food and many other inputs were already transitioning from canter to gallop before Ukraine. Disrupted supply chains did not originate with the Russian invasion. No man nor country is an island. The goal of all business activity is always and everywhere the same — to satisfy customer needs, wants and desires. Anything that raises customer prices depresses demand and crowds out other purchases, lowering economic activity. Facile projections of the benefits of rebuilding war ravaged countries (the broken window fallacy), or profligate government spending generally, were found wanting in 1850 by economist Frederic Bastiat, and yet they live on, unquestioned by many, to this day.

Significant supply chain disruptions began with the metastasis of COVID in the Far East, prompting a larger overdue discussion on the topic. While it would be pleasant to muse otherwise, we have enemies in the world who aim to do us harm. We have all benefitted enormously from an expanding global supply chain, technically since WWII, but in earnest since the fall of the Iron Curtain in 1991. Any disruption to unrestricted free trade is a negative for the consumer. We must now determine what that balance should be as if our lives depended on it.

Beth Genter, Schenley Capital

Europe, as a whole, is dependent on Russia for oil (25%) and natural gas (40%). This is a dire situation. The Nord Stream offshore gas pipeline which transports natural gas from Russia to Germany could, in theory, be shut off by Russia at any time. While discussions are underway with Qatar to bring gas in liquified form (LNG) to Europe, the receiving terminals have yet to be constructed. Therefore, the threat of pipeline closure creates considerable pressure on the European economy and is causing a slow-down across the board. On the other hand, the U.S. is much more energy independent as it produces, refines, and stores its own oil and has an over-supply of natural gas. The supply chain issue is different. These were disrupted long before the Russian invasion of Ukraine (COVID, etc.,), and affect both the U.S. and global economies. Nevertheless, the invasion did not help matters and we believe that this disruption will continue, at least in the short term, to cause increases in the price of many essential goods including food.

Joseph A. Scarpo, CAPTRUST

The invasion of Ukraine has led to tragic loss of life and widespread human suffering. It’s impossible to consider the economic implications (measured in dollars, euros, yen, and yuan) without first acknowledging the humanitarian implications that are measured in human lives and destroyed cities.

That being said, the economic consequences of the war and the resulting financial sanctions imposed on Russia will be far-reaching and risk tipping Europe into a recession as commodity prices spike and the infrastructure of global trade is further damaged. Russia is the world’s second-largest net exporter of crude oil and is the largest supplier of natural gas to Europe. Higher energy prices threaten consumer pocketbooks and demand, as well as corporate profit margins. Thus far, the impact on oil prices has been partially offset by reduced demand due to China’s severe COVID-19 lockdowns and releases of oil from strategic petroleum reserves. However, we expect more price volatility in the months ahead.

Another significant impact will be on global food commodities. Russia is the world’s leading exporter of fertilizers. And together, Russia and Ukraine export almost 30 percent of the global trade in wheat. The combination of sanctions and disrupted production, lower crop yields from fertilizer shortages, and rising food commodity prices poses risks for global food stability, particularly across Africa and the Middle East.

Win Smathers, Shorebridge Wealth Management

Supply chain disruptions that emerged during the pandemic coupled with extraordinary government stimulus and the Fed’s easy monetary policy are the main culprits of inflation in the US. The war in Ukraine has exacerbated the rapid rise in prices as sanctions placed on Russia effectively are removing a major supplier of oil, natural gas, wheat, fertilizer and other commodities from the global marketplace while post pandemic demand surges higher. Eventually, new suppliers will emerge to reduce the commodities supply shock, but this takes time so inflation seems likely to persist. The bad news is that inflation is a tax on the consumer and can reduce demand, thus slowing the economy. Fortunately, corporate balance sheets are flush with cash and profit margins are near all-time highs as are wages and household net worth, providing some resilience to higher prices. Furthermore, the stock market and housing have shown that they can perform well during inflationary periods. That said, the Fed has stated it will likely become more aggressive in raising rates which may add additional strain to the economy and the inversion of the yield curve is saying recession may be on the horizon.

Robert Kopf Jr., Chairman Emeritus, Smithfield Trust Company

We expect the Russian invasion of Ukraine to have an increasingly significant impact on our domestic economy, especially with respect to the prices paid for energy and agricultural commodities. Furthermore, the Ukrainian conflict will have an even greater adverse effect on Europe and emerging market economies.

The raging political debate in the United States is whether the Biden Administration should reverse course and return to full energy independence here. As of this writing, such a course correction appears doubtful, but, as we move closer to the November elections, political pressures on the Biden Administration may alter this dynamic.

Peter Mathieson, Fairview Capital

The current sophistication of the globalized economy has built in resiliencies to account for major disruptions like what we are experiencing with the war in Ukraine and our own politically driven policies. The implications of these events now show up quickly in the form of inflationary pressures, as prices rise to account for the supply and demand imbalances. In the past, prices would adjust over the course of many months, given the connectedness of today’s supply lines these changes now occur over days and weeks.

Malcolm E. Polley, Stewart Capital

The Russian invasion of Ukraine just exacerbated a problem initially caused by COVID. The biggest pain has been, and likely will continue to be in Europe and other areas of the world that had depended on Russian energy and Ukrainian grain – including Russia. That is not to say that the impact of reduced supply coming from Russia and Ukraine won’t impact everyone. While the United States does have some capacity to increase energy supplies to replace Russian energy supplies, Russia is the source of most of the excess capacity for fertilizer – both potash-based, and nitrogen-based. The loss of those supplies is driving fertilizer prices up dramatically around the globe. This will drive up food production costs which will severely crimp farmers’ profits and may cause a reduction in production further driving up food costs. Global economies may likely slow as consumers react to even higher prices – potentially pushing us closer to recession.

Steven M. Krawick, West Chester Capital Advisors

While handicapping the evolution of events in Ukraine is difficult, for now the best bet is that a negotiated settlement will occur before too much damage is done to the global economy. For investors, key capital markets indicators show that a significant slowdown in global growth is already discounted. Once a cessation in hostilities is in sight, we would expect global equities to have meaningful upside. U.S. stocks will remain a safe-haven for equity investors in the short run, but euro area stocks will likely have strong upside thereafter if a resolution to the war can be achieved.

Central to the outlook is our assessment that the global economy was on a sounder footing than the consensus believed prior to the outbreak of the war. Thus, if a settlement, or less favorably a military stalemate, emerges reasonably soon, as we expect, then the damage to global growth should be limited.

We expect equity markets to continue to be volatile in the year ahead even once the war moves off the front page given elevated inflation, a steady rise in interest rates from extremely low levels, and more moderate earnings growth. Overall, we expect decent absolute equity returns following the correction.

David Nardiello, MFA Wealth

Wheat futures are exemplary of the weak food supply chain acutely related to that region of the world. Oil prices were back close to the pre-COVID highs and increasing since early 2021 – the invasion simply added another layer of complexity in sourcing our energy needs. Increased prices on both fronts have far reaching consequences for the global and U.S. economies. The food and energy vectors have a disproportionate effect on the lower and middle classes where these expenses comprise a larger percentage of their annual budget. These now impinged constituents represent significant global demand and their diminished consumption in this scenario will be felt in decreased corporate earnings – particularly companies offering non-essential discretionary products and services. If these price increases are not transitory, global leaders will need to rethink their food and energy policies to balance their environmental goals with the economic trade-offs.

Leo P. Grohowski BNY Mellon Wealth Management

Russia’s invasion of Ukraine adds near-term growth risks for the global economy and will keep inflation elevated for longer. The war also comes at a time when central banks are tightening monetary policy to combat already elevated demand-led inflation resulting from the pandemic.

Economies that are more dependent on Russia for energy, like Europe, have the greatest potential for a decline in economic activity. Also, those emerging markets that import energy may feel the pressure.

The impact to the U.S. should be more minimal given it is more isolated from the crisis and more energy independent. We expect the U.S. can endure a period of higher oil and food prices, given its strong labor market and healthy consumer and corporate balance sheets. Yet, the war will keep upward pressure on commodity prices and exacerbate supply chain disruptions. These factors, along with the Federal Reserve’s aggressive tightening cycle, have led us to moderately lower our U.S. GDP forecast for 2022 from 4% to 3%-3.5%.

A protracted conflict will likely push inflation higher and global growth lower. If this happens, global and U.S. growth will depend on central bank actions against inflation and how successful the Fed will be in navigating a soft landing.