Spitting Into the Wind, Part III

I’m perfectly well aware that Noel Coward once remarked that reading a footnote is like having to stop making love so you can go downstairs to answer the door. But what did he know? I love footnotes. In his (much over-praised) book, “Infinite Jest,” David Foster Wallace included almost 100 pages of footnotes, which was terrific. Unfortunately, he …

Bloggy, Blog Blog…

We’re talking about my blog—blogging about blogging, talk about a navel-gazing exercise—and also about the book of blog posts that I just published. Selection criteria Since there exist, as of this moment, well over 300 of my blog posts, averaging 1,000 words each, I couldn’t simply publish all of them. That would result in a …

Spitting Into the Wind

The first blogging software hit the market in 1999, but it was a technology in search of a use. I never even heard the word “blog” until the early 2000s, and didn’t focus on it until, in 2004, the Merriam-Webster Dictionary selected “blog” as the Word of the Year. (It’s a truncation of “web log.”) Even then …

The Dear John Letter (to your Financial Advisor)

For many people, the worst part of the process of terminating an advisor happens at the very end, when you finally have to tell the guy the relationship is over. Think about that love affair that just wasn’t right. You knew that he/she was wrong for you, but actually breaking off the relationship filled you …

The Dear John Letter (to your Financial Advisor) Read More »

Firing Your Financial Advisor, Part III

Now that we know why we’re going to fire our financial advisor, let’s talk about when to do it. Obviously, if any of the issues I detailed in my last post are operating, the time to fire your advisor is ASAP. But even if no hot-button issues have raised their ugly heads, that doesn’t necessarily mean that all is …

Firing Your Financial Advisor, Part II

If you Google “Should I fire my financial advisor?” you will land on a lot of brain-dead articles. If any of the reasons listed in those articles apply to your financial advisor and you haven’t fired him, you’re probably hopeless. But in the interest of comprehensiveness, let’s take a quick look at reasons to fire your advisor right …

Firing Your Financial Advisor

“You’re fired!” – Donald Trump. The incredible—and incredibly long—bull market in both stocks and bonds that has persisted since the end of the Global Financial Crisis is now teetering. Whether or not the market bloodbath that occurred in October continues, the bull will in fact come to an end one of these days. When that …

On Children’s Literature

“Why do we give children the illusion of a world that doesn’t exist and which all their lives they will compare with a harsh reality?” –Georges Simenon A few weeks ago I published my 300th post since I launched the blog back in 2013. In recognition of this dubious anniversary I’m going to talk about …

Why We Don’t Take Our Meds: The Conclusion

“If you torture data long enough, it will confess anything.” –Nobel Laureate Ronald Coase “[Medical] science is really hard to turn around. People get emotionally invested, financially invested, professionally invested.” –Dr. Jonathan Moreno, Professor of Bioethics, University of Pennsylvania Last week I pointed out that a ridiculously expensive drug ($15,000/year) that had to be taken …

No More “Bad Cholesterol”? Not So Fast…

Men occasionally stumble over the truth, but most of them pick themselves up and hurry off as though nothing had happened – Winston Churchill It was mid-2015 and I knew I was in trouble as soon as I walked into my doc’s office – he was grinning from ear to ear and waving a piece …

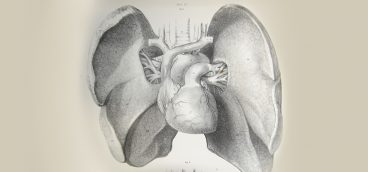

The Heart Cholesterol Complex

It is difficult for a man to understand something when his income depends on his not understanding it. H.L. Mencken About the time World War I was breaking out in Europe, doctors conducting postmortem exams on heart attack patients discovered that those patients’ coronary arteries were gunked up with cholesterol. “Aha!” said medical science, “People …

The Really Horrible Versus the Ordinarily Horrible

By “PVCs” I don’t mean the stuff they make pipes out of. I mean “premature ventricular contractions.” When people have heart attacks, especially serious ones, heart muscle dies and turns into useless, deadweight scar tissue. To make matters worse, hearts that are pocked by scar tissue conduct electrical waves very differently than hearts that are …

The Really Horrible Versus the Ordinarily Horrible Read More »

How Many Heart Beats Do You Want?

So there I was, at the end of April 2015, off all my prescription meds. (I still took a baby aspirin and a multivitamin, don’t ask me why.) I was feeling great and knew I needed to exercise, but knowing and doing are two very different things. Before my heart attack I had a very …

Who Says There’s Really “Prediabetes”?

I want to launch this post with a disclaimer—don’t do what I did. On the other hand, the usual advice—consult with your physician—might be even worse, for the reasons I’ll get to. After my 2015 stress test (described in last week’s post) I had a very depressing follow-up call with my doc. “Your ejection fraction …

My Eureka Moment

So there I was in early 2015, six months after my heart attack and open heart surgery, taking 12 meds and being urged to add another two to the regime. Instead of rebelling, I was Mr. Goodpatient, passively doing whatever I was told, however insane it seemed. When you’ve had a heart attack, one of …

Why We Don’t Take Our Meds (Again)

Recently, two journalists (Tim Harford and Simon Kuper) working for the Financial Times of London attended the FT Weekend Festival. The topic of their onstage conversation was “the nightmare of writing a weekly column.” Tell me about it. I don’t know about Harford and Kuper, but when I’m stumped for a subject to write about …

Fed Folly and its Practical Effects

“The… task of economics is to demonstrate to men how little they really know about what they imagine they can design.” –Friedrich von Hayek Adam Smith was the first to name the “the invisible hand” so felicitously, but he was hardly the first to notice the existence of such a phenomenon. The idea of an …

The Red-Tape Fed

The long and deep recession of 1930–33 finally ended in March of 1933. Once it ended, the Fed, believing that the economy could now—and should now—fend for itself, backed off. The result was one of the most powerful economic expansions in U.S. history, an expansion that lasted three decades. The short and shallow recession of …

The Fed’s Act of Cowardice

We are talking about America’s Monetary Keystone Kops, who have, since 1987 (when Greenspan became chair of the Federal Reserve), been masquerading as central bankers. (Or maybe it’s the other way ‘round, it’s hard to tell.) The Fed’s finest hour was saving Bear Stearns while wiping out its equity holders and senior management—that is, the …

Bernanke’s Blunders

We’ve assessed the successes and failures of central bankers in the 1930s. Now let’s turn our attention to their modern counterparts. I will argue that, unlike the earlier central bankers, whose record was mixed but a net positive, our modern central bankers have done almost everything wrong—and for 30 years running. To wit: Like the …

Why Gold Had to Go

The “gold standard,” which prevailed in the developed world for many decades, simply means that some fraction of a country’s paper currency has to be backed by—that is, convertible into—gold. In the U.S. that fraction was 40 percent. Since a government on the gold standard can’t print money without increasing its gold reserves, society-destroying events …

Central Bankers Then and Now, Part III

Scholars of the Great Depression typically blame policymakers of the 1930s for failing to do four things: They failed to rein in the 1920s economic boom, allowing its collapse to lead to the worst depression in US history. Following the Crash of ’29, they failed to inject sufficient liquidity into the economy, causing it to …