If you think it’s hard understanding a George Will editorial, you ought to spend time with the technology intelligentsia as they evaluate a prospective investment in a start-up company.

Every industry has its own vernacular, but this gang can befuddle the most erudite among us.

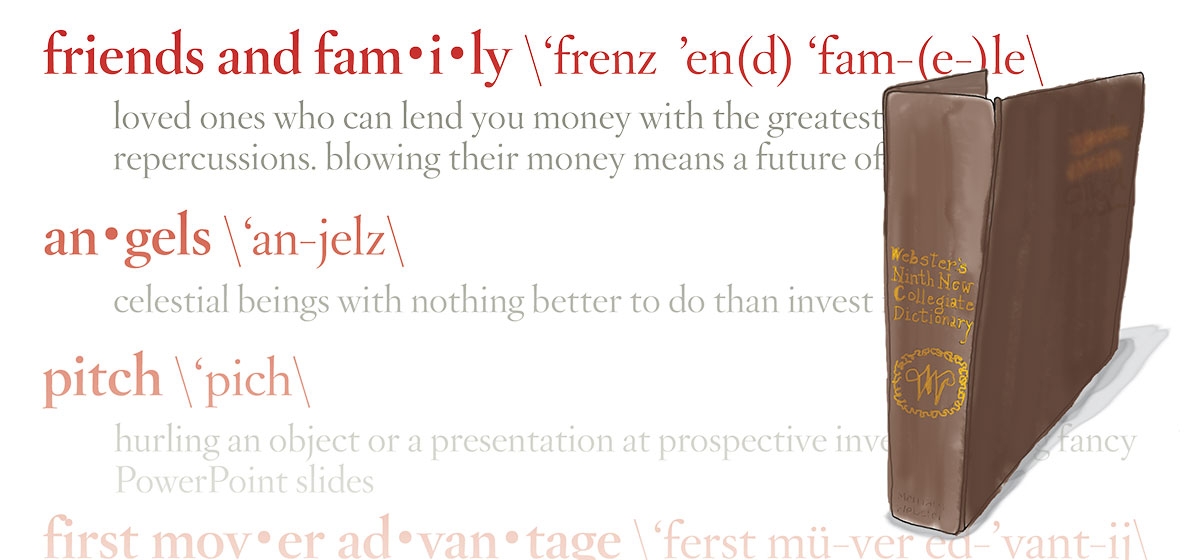

Show me the money: names for start-up investors

In the world of high-risk investment, people who buy stock in private start-up companies have names ranging from friends and family and economic development agencies to angels and venture capitalists.

“Friends and family” means just what you think. However, the start-up reference manuals at Barnes and Noble forget to tell you the risks if you blow their money. If you do, you probably won’t be able to sit at the cool kids’ table on Thanksgiving Day.

After you’ve exhausted Mom and Dad’s vacation money, you’ll climb the investment food chain to “angels.” High-tech angel investors are rich people with way too much time on their hands. More often than not, they have been in your shoes, so they tend to be an empathetic lot.

According to an article published by Harvard Business School, “the term ‘angel’ originated in the early 1900s and referred to investors on Broadway who made risky investments to support theatrical productions.” Today’s angel investors “pony up” for two reasons. First, they want to generate better returns than the S&P 500. Second, they like the action.

Most angels are successful entrepreneurs. Entrepreneurs start companies for personal freedom and the thrill of the chase. After they make their pile of dough through a buy-out or some other “liquidity event,” they go through a business jones that can only be satisfied by dabbling in another start-up company in between rounds of golf and attending charity events.

“Guardian angels” also give start-up companies economical “been there done that” management help. This proves invaluable because fledgling companies cannot afford executives or management consultants with such a high level of experience.

An ironic saying among start-up CEOs is, “It’s easier to raise $5 million than $500,000.” That’s because venture capitalists, a main source of speculative funding, must invest at least $1 million in a company. It’s a matter of portfolio management.

A good venture capital firm will hit big on two out of the 10 investments in its “portfolio.” According to Steven Rogers in “The Entrepreneur’s Guide to Finance and Business,” 7 percent of a venture firm’s investments account for the majority of its profits. Another reason is “bandwidth.” Venture capital firms aren’t that big in terms of headcount. It takes as much time for a VC to evaluate and keep tabs on a $500,000 investment as it does a $5 million investment. There are only so many deals in the day. Some people refer to VCs as “vulture capitalists.” I hate the term because it’s usually the wine of sour grapes. This term was coined by founders of companies that should have spent a little more time on their business plan.

In a lot of cases, management really didn’t know how much cash it would need to reach profitability because it miscalculated its monthly “burn rate.” A start-up’s “burn” is the cash it consumes every 30 days because it isn’t selling enough products with gross profits sufficient to cover its expenses.

When it comes to business valuations, “comparable market prices” rule. A “comp” is a company with the same characteristic as yours in the same industry. If somebody paid x to invest in a company similar to yours, more than likely you’re not going to get x + 1 for your company.

And beauty is always in the eye of the beholder. This is where one learns another esoteric term: “the golden rule.” Whoever has the gold rules.

Another name for venture capital is “private equity.” The difference between private and public equity is simple. Private equity firms make investments for clients by buying stock in companies not traded on a public market exchange, such as the New York Stock Exchange or NASDAQ. Public equity firms are called stock brokers.

Making the pitch

Raising money for your start-up in as orderly a manner as possible is called “the deal.”

Imagine yourself entering the office of a well-heeled venture capital firm seeking investment in your whiz-bang new idea: a dental floss dispenser for iPods.

You walk into a technology-laden conference room resembling the command center on “24.” The walls are filled with framed “Tombstones.” Financial tombstones are announcements of successful transactions printed on little vellum cards and mailed to prospective and existing clients of investment companies. So why would you announce something good happening on something called a tombstone?

You’ll be greeted by the smiling face of one of the firm’s partners. Don’t be afraid of these folks though. They only went to Stanford, CMU or Harvard Business Schools, after having spent five years as nuclear engineers or molecular biologists.

In the world of raising start-up money, a “pitch” is a 20-minute presentation that presents your idea in the form of 15 fancy, well-animated PowerPoint slides. During your pitch, you should present a problem solved by a proprietary product in a huge, addressable market that has yet to be penetrated. Having that problem regulated by the federal government is also a nice touch.

About 15 minutes into the pitch, you’ll figure out which investors like your “story” if you start hearing some fun new words.

Your prospective investors will ask if your business is a vertical or horizontal, at which time you will look at them sideways and ask for an explanation. A “vertical” market is one where you sell the same customers a lot of different stuff. A “horizontal” market is where you sell a lot of different customers the same stuff.

Then they will ask how you will protect your FMA. FMA is not the adult version of the 4H where they have a lot of cows instead of one baby calf. FMA stands for “First Mover Advantage”.

First Mover Advantage is not leaving the Pirates game at the bottom of the eighth inning. It’s selling a bunch of your stuff before anybody gets the bright idea to copy your stuff because there is a lot of money to be made selling stuff like yours, but less expensively.

Then they’ll ask you about your IP. You’ll first say, “No. I stopped by the gas station before I got here.” After you’ve learned that IP means intellectual property, you’ll get into a discussion about why you haven’t spent a lot on money with an attorney, who specializes in filing patents.

So what’s the difference between patent applied for; patent pending; and a patent? The answer is about $25,000.

Almost there

Providing this goes well, you will begin to discuss “valuation,” which is essentially how much your company is worth. From their perspective, it’s really a discussion about how much of your company they will get in exchange for the cash you will get.

During this chat, you’ll review your “pre-money” valuation and “post-money” valuation. “Pre-money” is not copper, silver and gold before it gets melted into coins. It is the value of your company before they invest. “Post-money” is not how they mail you the check. It is the value of the company after you get the money.

In between the time an investor decides he wants to put money into your aforementioned dental floss gizmo company and you get the money, they start looking at ways to discount the “pre-money” valuation.

The first discount is levied because you and your management team are inexperienced. There is a discount if your product isn’t finished yet. There is a discount if you don’t have a big-name customer. There is a discount if you are not profitable. There is a discount because you watch “Dancing with the Stars” regularly, and so on.

Finally, the prospective investor will want to discuss your thoughts on your “exit strategy.” Answering you’ll probably take the Parkway if you can get out of there before 5 p.m. is not a good answer. In terms of start-up investing, the “exit strategy” is how the investors

Finally, the prospective investor will want to discuss your thoughts on your “exit strategy.” Answering you’ll probably take the Parkway if you can get out of there before 5 p.m. is not a good answer. In terms of start-up investing, the “exit strategy” is how the investors will get their money back, but only if they can get a return of five to 10 times their original investment.

Toward the end of the meeting, they’ll throw in that they want a board seat for the firm, one for an industry expert that they have known for many years, and one for a former CEO of a company in which they have previously invested. They’ll leave two seats for your company’s management. No, there’s nothing wrong with your math. Three for them and two for you means that they can whack you if you screw up.

About that time, you excuse yourself from the meeting and inform your prospective investors that this was a bad idea and that you are instead going to attempt an assault on K-2 in Nepal this summer.