Masters of their Fate

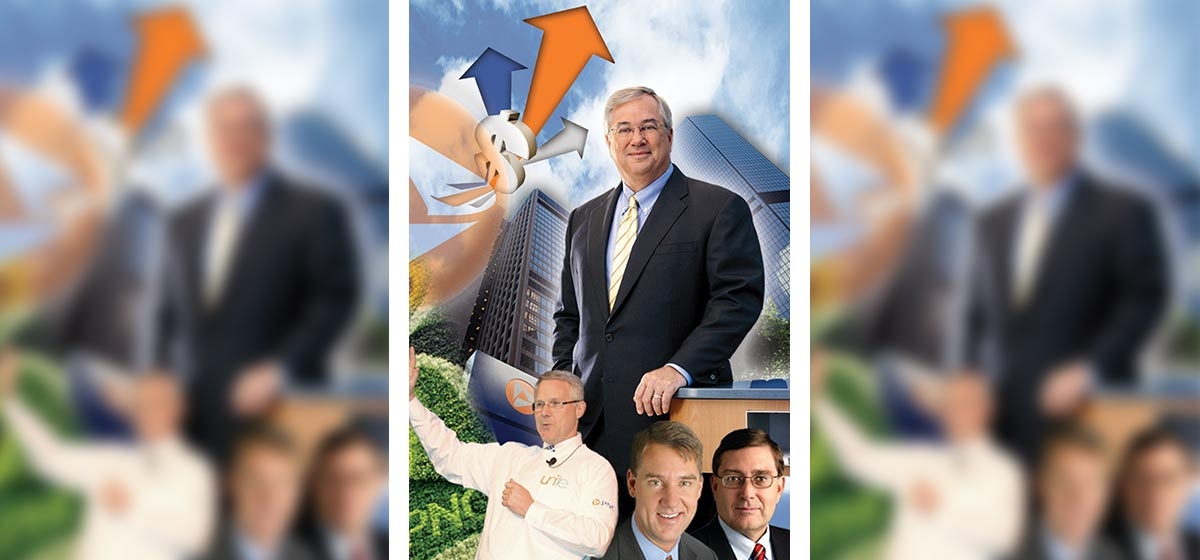

Dawn was still hours away when Jim Rohr emerged from National City Corp. headquarters in downtown Cleveland on Oct. 24, 2008. The streets were empty, but familiar. His grandfather’s deli had stood just across the street.

Not far from there was where his father had moved the deli, which later became a restaurant. Rohr worked there as an adolescent, helping his mother keep it open following his father’s death. Now, some 50 years later, he was standing at the corner of 9th and Euclid as chairman and chief executive officer of The PNC Financial Services Group. But Rohr’s visit to the city of his childhood wasn’t about memories. He came to close the business deal of a lifetime.

Shortly before midnight, Rohr and a PNC management team had negotiated a deal to acquire National City, the nation’s seventh largest bank as measured by deposits. Seen by some as a shotgun wedding, the deeply troubled Cleveland bank had been pressured by federal regulators to find a buyer, having run out of options for saving itself from mounting losses and other problems, including a substantial, crippling stake in a subprime mortgage market that was in freefall.

A month earlier, the global financial services firm, Lehman Brothers, had collapsed and filed for bankruptcy protection. Washington Mutual, the nation’s largest savings and loan association, became the nation’s largest bank failure. Two dozen other banks had followed suit, and a few hundred more were teetering on the brink. Insurance giant AIG was also flirting with failure, posting losses that would total $100 billion that year and watching its stock price fall by 95 percent. The economy was shedding 250,000 jobs per month, and by all indications the worst was yet to come. News outlets were rife with reports speculating that the nation was on the verge of another Great Depression. Consumer confidence was sinking. Fear was rising. The economy was contracting, and where it was headed was anybody’s guess. You didn’t have to be a banker or economist to know that these were dicey times for business deals of any magnitude.

But there was the PNC team at National City headquarters in the quiet predawn hours with a $5.6 billion deal in hand that would double the size of their Pittsburgh-based bank. As Rohr stood at the confluence of his past and the uncertain future PNC was about to embark upon, the words that came to him were, “Holy smokes. What have I gotten myself into?” A moment of reflection was all he could spare. The work of transforming two banks into one would begin that crisp October morning with PNC officials notifying shareholders and the public of the bank’s acquisition and meeting with National City employees anxious for word about what it meant for their future.

Only a few decades earlier, PNC’s predecessor, Pittsburgh National Bank, had been the fourth or fifth largest bank in Pittsburgh. With the National City deal, PNC would become the fiftth largest bank in the United States with more than $180 billion in core deposits, 56,000 employees, more than 2,500 branches and 5 million checking account customers.

For western Pennsylvania, the implications of the merger included a more stable source of employment at a time of great instability in the job market. For Pittsburgh, it has led to development to accommodate the bigger company, including the expansion of its downtown campus with the $100 million Three PNC Plaza, the city’s first skyscraper in 20 years, which was built to “green” Leadership in Energy and Environmental Design standards. The bank also boosted its annual charitable contributions to $50 million throughout the communities it serves. PNC was already more than halfway into a 10-year, $100 million commitment for a special initiative to improve the school-readiness of children from birth to age 5—perhaps the most critical period in terms of influencing a child’s academic outcomes and overall future, but one that Pennsylvania and other states historically hadn’t given much attention.

“Their impact on the region can’t be understated,” says Dennis Yablonsky, executive director of the Allegheny Conference for Community Development. “Financial services is one of the five key sectors driving our economy. To be able to talk to companies about the world-class banking we have in the region is important.

”Job prospects for graduates of local business schools also have improved. Those hired are often plucked from the corps of summer interns PNC brings in every year. “Up until about a year or so ago, PNC was hiring about 100 interns a year, many from the University of Pittsburgh,” says Jay Sukits, a Pitt business administration professor and internship coordinator. “This past summer, they brought on about 600 interns. That’s hugely positive for us and other schools and the region.”

Much of that would not have been possible had PNC not been positioned to seize the opportunity that a weakened National City presented. A previous series of smaller, but successful, acquisitions had given PNC’s management team the experience and confidence to consider itself capable of merging operations with a distressed institution the size of National City. PNC’s 86 percent loan-to-deposit ratio meant the bank was not highly leveraged. And in a liquidity crisis as deep as the one strangling the economy in 2008, liquidity was the most valuable card a bank could hold.

How PNC found itself well-positioned for a major mid-recession acquisition has much to do with the standards and culture that had evolved at the bank and the experiences of those running the company, several of whom have been at PNC for decades.

The Mellon Factor

When PNC president and Tarentum native Joseph Guyaux began his job search after earning a degree from Brown University in 1972, Pittsburgh was high on his list of the places in which to look. “When I thought about coming back to Pittsburgh, the bank I thought about was Mellon Bank, because Mellon was – it was almost an honor to be a customer of Mellon.”

Throughout the 20th century, Mellon Bank was the chief rival of anyone doing banking in the city. Mellon controlled the large corporate accounts when industry reigned and Pittsburgh was home to more corporate headquarters than all but a few other cities. Companies such as Gulf Oil, Alcoa and U.S. Steel had been nurtured to greatness by Mellon and were loyal to the prominent Pittsburgh bank and family. In addition, the region’s industry and wealth attracted banks from New York, Chicago and places as far away as California.

Guyaux landed instead at Pittsburgh National around the same time Rohr joined the bank. “We were neophytes, and the competition was formidable,” says Rohr. “It was the kind of competition that, if you were going to play, you had to play at their level. And I think it caused us to make products and services more aggressively than our national peers.”

PNC looked outside Mellon’s sphere of influence and made serving smaller businesses and mass-market consumers a strength. “We took advantage of the places where Mellon wasn’t as strong or as interested,” says Guyaux. “We made our name as the bank for the average person, for the small business, for the middle-market companies.”

They also called on the larger companies, but not always at the CEO and CFO levels where loyalty to Mellon was often unshakable. “We’d call on controllers, assistant secretaries—people two or three levels down who, over time, would be running the company. We’d talk about what we could do, ask how things were going, what gives them problems, and try to find solutions for them. We’d take care of their personal business. We saw them at the Little League games. We built relationships. They were our friends on their way up, and, once they got there, we started to get part of the business.”

One story that illustrates the underdog aggressiveness of PNC’s young turks in those days is still making the rounds at One PNC Plaza. “There’s a legend around here about me that I made up products that we didn’t have,” Rohr says. “There’s some truth to that, actually.”

As he tells it, he called on a contact at Westinghouse who was looking for a bank able to implement a complex plan for processing the company’s receipts from around the country, a banking process generally known as treasury management services. Receipts were to be gathered from lockboxes and banks from coast to coast. Various banks would transmit information from each check on magnetic tape, paper tape or fax to PNC or whoever else got the job. PNC then would reformat the information; proof it; run it through its computers and the company’s computers to the Westinghouse receivables system; update the day’s receivables; and get everything done by 10 o’clock every night. “Can you do it?” his Westinghouse contact asked. “Sure,” Rohr recalls saying without first checking with his office to see if it was possible.

“He said, ‘Okay, you have a deal.’ Then he said, ‘You know, Mellon Bank said they couldn’t do it,’ which should have been a red light for me,” Rohr says.

“But when I was a trainee, they sent me to the operations building, and I had to sort checks. I knew we had a magnetic tape machine because we had one magnetic tape customer, Marquette Cement. I knew we had paper tape machines and computers. And it didn’t make sense that we couldn’t have somebody write this stuff down and reformat it. So, I was confident that our people could do it. And they did.”

Road to super regional

By the mid-1990s, deregulation was fueling major changes in the banking industry. The loosening of the reins allowed—and to some degree encouraged—mergers between banks. With the relaxation of interstate banking regulations, a new breed of bank, the superregional, emerged, and it wasn’t long before PNC seized the opportunities that the shifting landscape offered.

Under Thomas O’Brien, who replaced retiring Merle Gilliand as CEO in 1985, PNC grew at an accelerated pace with a series of bank acquisitions. Hershey Bank, Citizens Fidelity Corp. of Louisville, Central Bankcorp of Cincinnati, MidAtlantic Corp. of Edison, N.J. and Chemical Banking Corp. branches in New Jersey were all on the list. PNC also acquired non-bank entities, including the Massachusetts Company, to boost its wealth management services offerings, and BlackRock Financial Management, one of the largest investment managers in the nation.

The surge in acquisitions was neither scattershot nor seen as reckless by analysts. PNC favored healthy banks, and its acquisition criteria were considered strict by industry standards. By the end of the 1990s, PNC had become one of the nation’s top superregionals, having expanded its reach across Pennsylvania and into Ohio, Kentucky, New Jersey and Indiana.

Around the same time, a more cautious approach to lending evolved within the bank that would prove critical in positioning PNC to acquire National City.

PNC had long been considered one of the more prudent lenders in the industry. When the nation’s economy began to weaken in 1999 and banks began to experience leaner returns on lending, PNC moved to a moderate risk profile through which it continues to filter its lending activities. In essence, the bank began to use stricter criteria when weighing the risk of default against what it could earn on each loan. On the front end, that could mean charging higher interest rates or denying more loans to less creditworthy applicants. On the back end, it meant the bank was more likely to liquate a loan that looked to be in danger of default.

“We do a lot of business with a lot of different customers, so we keep our exposures granular,” says Thomas Whitford, PNC vice chairman and head of technology, operations & regional presidents.

“When you have granular risk, yes, some customers aren’t going to pay us back, but if one or two or three customers don’t pay you back, it doesn’t put big holes in the side of the ship.”

Between 2000 and 2002, PNC reduced its credit commitment by $50 billion. “We had started to see banks massively competing for any kind of asset they could put on the books because fee income and loans were falling dramatically,” says Rohr, who was named CEO in 2000 and chairman the following year. “They had to scramble. And the first thing that happened was they cut prices. That’s when we realized that the spreads and fees had fallen so much we weren’t getting paid enough to take the credit risk. So we started to change our risk profile.”

Enron’s long shadow

Under Rohr, PNC continued to expand with several key acquisitions, including Washington, D.C.-based Riggs Bank, which for most of its history stood as the largest bank in the nation’s capital. But Rohr had to survive a stinging, very public controversy over a bank accounting maneuver that led to calls for an early end to his chairmanship, including a Businessweek editorial that ran under the headline, “Memo to PNC: Show Rohr The Door.”

In January 2002, only eight months after Rohr was named chairman, PNC disclosed that federal regulators were investigating a bookkeeping maneuver made the year before that moved $720 million in troubled or non-performing loans and venture capital assets into off-balance-sheet entities. Although PNC’s outside auditors approved the move, the Federal Reserve Board ruled it improper. The Securities and Exchange Commission would later find that the practice “camouflaged” risk and led to statements that misled shareholders.

PNC stock fell 9 percent when the news was made public and it tended to skid for several months afterward—a reaction most analysts argued was unwarranted given the amount of assets involved, the fact that the bank had restated its earnings, and that, although PNC was put under federal oversight for six months, the SEC had chosen not to fine or otherwise penalize the bank.

But shareholders and regulators had reason to be wary of bookkeeping practices that shaped the financial statements of companies. A few months earlier, news of the massive accounting scandal involving the Enron Corporation stunned the business world and the nation. Through accounting schemes, the Houston-based energy giant hid billions in debt and losses from failed deals and projects. Shareholders ended up losing $11 billion, Enron went bankrupt, and one of the world largest accounting firms, Arthur Andersen, was dissolved.

The scandal heightened scrutiny over corporate accounting practices, and regulators were in no mood to show leniency, as noted in the same Businessweek editorial that had called for Rohr’s departure: “Regulators say privately they wanted to make an example of PNC because it abused off-balance-sheet entities—a particular concern post-Enron.”

Fallout over SEC oversight and the problems that brought it on included several departures from the halls of management at PNC, the bank’s chief financial officer among them. But PNC’s board stood firm when it came to Rohr. He would stay on.

“You have to remember what it was,” says Rohr. “We were reducing credit risk. The accountants had come to us with a method by which we could sell a portion of our risk—which we lost money doing. The Fed disagreed with our accountants. We stuck with our accountants and lawyers. What did I learn? I learned you have to pay a lot of attention to the Fed. Going forward, our relationship with regulators changed. They went from being perceived as simply regulators, an outside third party, to our partners. And that was a major change in the culture of the company.”

The episode resulted in new additions to the management team, including William Demchak, the global head of Structured Finance and Credit Portfolio at JP Morgan Chase, who became the new PNC chief financial officer and, later, senior vice chairman responsible for all corporate and institutional banking. Demchak, who brought management depth and Wall Street expertise, was essentially named the heir apparent to Rohr just recently.

Internally, the bank also became less fragmented. Previously, it had been divided into silos with many of its businesses treated as separate companies to the extent that they had their own human resources and regulatory people. As a result, one hand didn’t always know what the other was up to.

As the silos began to erode, a stronger team approach took hold as the bank addressed its SEC problems. “I think Jim from the start felt that if we did this right it would be advantageous to us as we moved forward,” says Guyaux. “And we did. We went at it as a team and came out of it as a team, and we gained a lot of confidence in each other and this company’s capability to execute around certain things. We also had a better understanding of who we weren’t.”

An important test came in 2005 when PNC decided to acquire Riggs, a commercial bank known for catering to diplomats and embassies that was so scandal ridden few banks would touch it. The problems at Riggs included several federal investigations, which had turned up evidence of shady CIA connections and money laundering for a clientele that included Augusto Pinochet, the deposed Chilean dictator who had been chased from his country by accusations of corruption and torture.

Having managed a regulatory crisis of their own boosted the confidence of PNC officials that they could extract the benefits that the Riggs commercial branches offered from the mess that surrounded the bank’s international dealings. With bank regulators watching, they sold the Riggs embassy business, which they neither wanted nor had the experience to run. And within months, they retired the Riggs name and smoothly brought its Washington branches into the PNC family, giving PNC a foothold in the nation’s capital and erasing any doubts in their minds and in the minds of regulators about their skills in mergers and acquisitions.

The next few years saw a flurry of commercial bank acquisitions, which further broadened PNC’s presence across Pennsylvania, Maryland, New Jersey and Delaware. And Rohr experienced a personal reversal of fortune of sorts when the financial services daily, American Banker, named him the nation’s top banker in 2007. Meanwhile, signs were emerging of grave weaknesses in the financial industry that would soon bring the economies of nations to their knees and profoundly change the face of PNC.

The gathering storm

“We had felt National City would be a good fit for about 25 years,” Rohr says. “Tom O’Brien and I played golf with all of the predecessor management back in the 1980s. The geographic and cultural fit of the two institutions seemed to make sense for a long period of time, but we could never figure out how to pay the price and how to put the two banks together.”

Such a scenario became more defined when markets and mortgages tumbled in the fourth quarter of 2007 and worsened after New Year’s Day. National City’s stock fell steadily. After hitting its 2007 peak of $38.94 per share on March 1, the Cleveland bank’s common stock dropped to around $13 a share in January. The mortgage crisis rippling across the nation was particularly damaging to National City. In addition to having a stake in the badly wounded subprime mortgage business, it had bought $9 billion worth of brokered home equity loans, more than half of them in California and Florida, where the housing crisis was most severe.

In public, National City officials expressed confidence the bank would recover. Quietly, however, they were frantically looking for a “strategic partner” to come to the bank’s rescue, according to published reports on the content of depositions and other documents from a shareholders lawsuit against National City. Later, the save-the-bank effort would be given a clandestine name: Project Falcon. The list of possible saviors included PNC and other major U.S. banks, and code names such as “Whiskey,” “Kilo,” “Foxtrot” and “Sierra” were assigned to each. PNC is believed to have been “Papa.”

In Pittsburgh, PNC officials were increasingly aware of National City’s deepening crisis. Not only was National City’s exposure to crumbling high-risk mortgages known, but PNC was also picking up a growing number of customers fleeing its Cleveland competitor.

Pitt professor Jay Sukits sensed from visiting National City executives that the bank’s mortgage business was in trouble in 2007. “I had some very senior guys here to make a presentation and I mentioned the mortgages, which were starting to bubble. I had traded mortgages and managed trading businesses on Wall Street for 20 years, so I knew what was going on. I mentioned it to these guys and they looked at me like, ‘Shhh, don’t bring that up.’”

PNC didn’t have those worries. First of all, the bank was highly liquid. And never had liquidity been more important than in 2008, when the capital markets began to collapse. The bank, by managing to stay true to its moderate risk profile, had also avoided temptation and steered clear of the subprime and brokered home equity loans that were dragging down banks across the nation. “We felt we were in a good position, but that we were not immune,” says Whitford, the bank’s chief risk officer at the time. “Anyone who thought they were immune from what was going on in the world economy at that time was missing the point.”

That point was not lost on rival Bank of New York Mellon, which was threatened not by mortgage defaults, but a run on money markets in the fall of 2008, which Robert Kelly, the bank’s chairman and CEO, describes as “the scariest thing that ever happened to me.” Speaking to Pitt business students and faculty last year, he recalled how the bank had scrambled to buy assets to put on its balance sheet to prevent collapse, only to be spared in the nick of time by federal Troubled Asset Relief Program (TARP) funds. “If it had happened for another week, we would have been gone, because we would have run out of cash.”

If PNC feared anything, it was just such a loss of confidence among its customers. “Our biggest concern in the short run was the notion of liquidity runs on the bank,” says Guyaux. “We weren’t highly leveraged. But at some point in time, if everyone starts running to put money in the mattress, you might be the last one over the cliff, but you have the same problems around liquidity and access and funding of the balance sheet.” Such a run never materialized.

PNC officials first looked at buying National City in the fall of 2007. National City’s stock had dropped nearly 40 percent in six months. Still, at around $24 per share and given the weight of the bank’s bad mortgages and other factors, PNC officials couldn’t make the numbers work. They evaluated the risk-reward ratio. They asked themselves not just whether they could manage the risk they knew of, but whether they could manage the risk that might occur if economic conditions worsened. They passed again.

They looked at National City again in January 2008, when the bank’s stock price was around $13 a share. They passed again.For a moment, National City appeared to have found a way out when in April it secured a $7 billion capital infusion from equity investors led by New York-based Corsair Capital. But its troubles continued to worsen, its losses continued to mount, and its stock price continued to fall. In the eyes of PNC officials, the capital that investors pumped into National City certainly mitigated some of the risk of buying the bank. But the numbers still were not right.

Then, the bottom fell out. On Oct. 19, National City Chairman Peter Raskind received an e-mail message from the U.S. Treasury’s Office of the Comptroller of the Currency that contained nothing but bad news. National City would not get a dime of TARP money. The bank would soon have its rating downgraded by the Federal Deposit Insurance Corp. And, unless the bank found a buyer by Oct. 24, it would find itself on the FDIC’s list of banks most likely to fail. That would likely mean a run on National City. Only a few weeks earlier, the bank’s cash on hand had dropped from $12 billion to $6 billion in a matter of days when mostly large corporate and wealthy customers began pulling their deposits.

The court documents suggest that on the morning of Oct. 23, U.S. Bank was the only bank with an offer on the table, although what it was offering did not please the National City board. The bank was running out of options when Rohr called around 11 a.m. to say PNC was again interested. Although PNC hadn’t needed federal bank bailout money, it was promised $7.6 billion in TARP loans to help with an acquisition of National City should it decide to do so.

Around 8 p.m. that evening, PNC made a written offer that topped the deal offered by U.S. Bank, which chose to drop out of the bidding rather than match it. PNC’s offer of $2.23 a share was what National City had to live with or risk catastrophic failure in the morning.

Sometime after 2 a.m. on Oct. 24, the deal was done. And Rohr found himself standing in the quiet of a very familiar Cleveland neighborhood, having just bought the nation’s seventh largest bank for less than a quarter of what it was worth only a year earlier.

A ‘real jewel’

Buying National City for such a price would only be a bargain if PNC, during the depth of recession, could pull off the largest integration it had ever attempted in a way that would gain the confidence of customers, employees and shareholders.

Anxiety ran high among employees, particularly those who had been on the National City payroll. They had good reason to be concerned. Bleeding duplication from the merged operations meant eliminating jobs. Some 5,800 jobs were cut, including at least 500 from the 61 National City branches in western Pennsylvania that PNC sold to satisfy U.S. Justice Department antitrust concerns.

PNC seeded its integration teams with former National City officials, emphasized internal communication, rewarded employees of all ranks for ideas that made for a smoother transition, broke the conversion into a series of “waves” rather than a single marathon push and increased the bank’s charitable contributions in former National City communities. It was a huge job that included everything from replacing 21,000 National City signs to sending eight million pieces of mail to customers and spending some 2.5 million hours on training employees.

One early indication that the conversion might go well appeared during the first months of 2009, when a campaign that mobilized employees to win back lost National City business with sales calls and face-to-face meetings resulted in the return of $1 billion worth of deposits.

That December, a front-page photograph in the Pittsburgh-Post Gazette showed Rohr, BNY Mellon’s Kelly and Bancorp CEO Richard Davis leaving the White House after meeting with President Barack Obama. Although the headline is not one Rohr would frame (“Obama dresses down bankers. President calls for an ‘extraordinary commitment’ on loans, regulation, exorbitant pays”) the fact he’d been summoned at all was evidence of the National City acquisition’s impact on PNC’s standing in the industry and nation.

In June of this year, a milestone in that deal was reached when the job of converting six million customers and 1,300 branches from National City to PNC was finished five months ahead of schedule and without a serious hitch. “We knew when we looked at [National City] that if we could acquire the company, get rid of the subprime and the brokered home equity situation and figure out how to put it together with PNC, we’d end up with a real jewel,” says Rohr. “And that’s exactly what happened.”