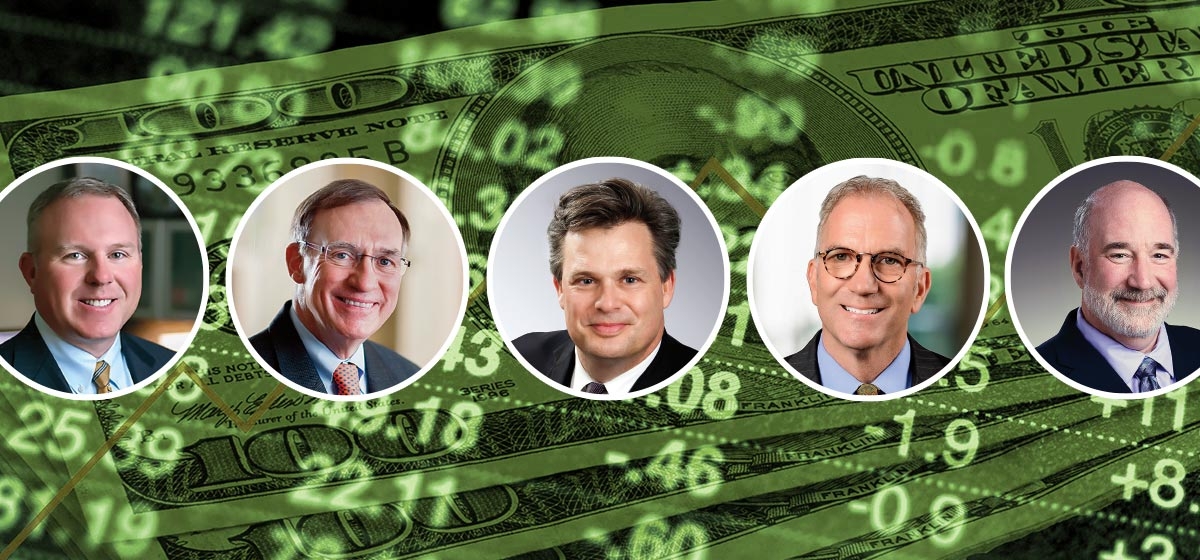

Three Questions on the Markets, Part IV

Each year in our Summer issue, we ask a group of the region’s leading financial experts to help our readers by responding to a series of questions. The final question is, “What effect will higher inflation have on stock prices?”

What effect will higher inflation have on stock prices?

Thomas L. Wentling Jr., Wentling Tarquinio Loughney Wealth Consulting Group, UBS Financial Services Inc.

The easy answer is lower stock prices—it’s just math. Higher inflation means higher interest rates. The present value of anything (stock, bond, real estate, pension payment) is simply all future anticipated payments “discounted” back to the present at an appropriate risk adjusted interest rate. Higher interest rates lower present values. Except… what if increasing interest rates are more the result of an improving business climate, abounding with attractive investment opportunities causing competition for scarce capital, than of increasing inflation? Interest rates are the cost of money, and real (inflation adjusted) rates are historically low. Higher interest rates always put downward pressure on fixed income streams, but for equities, and business in general, whose income varies with profitable opportunities, it could be “pink sky at night, sailor’s delight.”

Joseph Scarpo, PWA Wealth Management

The U.S. has experienced modestly rising inflation and interest rates along with a Goldilocks economic environment. The profit growth which should accompany worldwide economic expansion will support equity prices provided that an unexpected spike in inflation is avoided. Over full economic cycles, equity investors are rewarded for the risk that is taken. Historically, long-term inflation adjusted returns from stocks run about 5-6% while bonds and cash are either zero or negative. The short-term return is influenced by many things including inflation. Will inflation cause short-term volatility? Definitely. Will that result in a longer-term negative return for investors? History suggests otherwise.

David B. Ellwood, WesBanco

We would expect that higher inflation will slow the rate of advance in stock prices. This is often true of unexpected inflation since it frequently results in a delay by businesses and consumers in making the needed adjustments to increased costs. Economic policy that is designed to moderately increase inflation over time and is well communicated tends to have less of an impact on stock prices. The Federal Reserve has been focused on increasing the level of inflation to stimulate spending and maintain job growth and reduce the probability of deflation. Historically, inflation and stock prices have a low correlation but as level of inflation increases or the rate of increase accelerates the impact is negative.

Gregory J. Sorce, HBKS Wealth Advisors

Stocks can still do well during periods of inflation if the inflation is the result of strong economic growth. However, if fears of inflation cause the Federal Reserve to raise rates aggressively, economic growth could be short-circuited and stocks could struggle.

Elizabeth Genter, Schenley Capital

Rising inflation erodes purchasing power, which in turn reduces the power for individuals to spend on goods, services and investments. Investors try to anticipate the factors that impact portfolio performance and make decisions based on their expected outcome. Inflation is one factor which affects a portfolio and it is important. In most periods, there is a close correlation between high inflation and lower returns for the overall market. Investors divide stocks into growth and value categories and the evidence is clear that value stocks perform better in high inflation periods and growth stocks perform better during low inflation. This is one good reason that a stock portfolio needs to be diverse, that is to be comprised of large, small stocks, European, alternative and low volatility asset classes to mitigate the negative effects of inflation.

Thomas E. Crowley, KeyBank

Earlier in an economic cycle, rising inflation reassures investors that growth is sustainable. At that point, inflation can actually be good for stock prices. At this point, stronger inflation would raise the risk that the Fed will raise interest rates. Thus, strong inflation reports would currently put more pressure on stock prices.

Jeff Muhlenkamp, Muhlenkamp & Company

If we get sustained higher inflation it will push P/E’s downward and, unless earnings can accelerate fast enough to offset the decline, will result in lower stock prices overall. Historically, that’s been the pattern and we have no reason to expect it to be different the next time. The key question, of course, is: Will we get significantly higher inflation in the near future? We think it’s more likely than not, but it’s a low conviction call.

Linda Duessel, Federated Investors

Inflation has been uncomfortably low for so long that an improvement toward the Fed’s 2% target should be viewed as good for stocks. In fact, the Fed has suggested it would be comfortable with inflation running hotter than 2% for some time. Historically, it wasn’t until wage inflation hit 4% that the Fed has started to accelerate tightening—currently, year-over-year (y/y) wage inflation is running around 2.6%. And it wasn’t until CPI inflation went to 4% y/y that the stock market punished P/E multiples and stocks. Right now, it’s around 2%. My one worry: because rates and inflation have been spent so much time at generational lows, 3ish% could replace 4% as the wage threshold that gets the Fed and P/E multiples moving.

Alison Fox Wertz, Bill Few Associates

I had to chuckle this year when there was a headline about inflation reaching 2.1% and the market sold off on inflation fears. The Federal Reserve has been desperately trying to push inflation to 2% since the financial crisis. They finally achieve their goal and the market immediately jumps to the conclusion that inflation is out of control and the next recession is right around the corner. Stocks are a good asset class to battle inflation. They have the ability, I should say the companies they represent have the ability, to adjust to higher inflation. They can mitigate its impact through cost controls or higher productivity. Worst case they can pass higher cost through to consumers. Higher inflation may hurt stock prices in the short-term, but over the long-term you invest in stocks to grow your investments faster than inflation.

Jack Kraus, Allegheny Financial

A moderate pick-up in inflation would indicate a stronger or more robust economy. Generally, in this type of environment, the cost to companies does not out-pace the increase in sales, revenues, and profits. This would be a positive for the market and stock prices overall. The adverse effect is that as inflation picks up, so does the need to have a higher Fed Funds rate. This is generally a negative for the stock market. It will become a balancing act between the two forces and the market’s interpretation of which of the two forces is stronger. If inflation rapidly accelerates, the market view would be negative, and prices would fall.

John Augustine, Huntington Bank

Higher inflation (and Federal Reserve response to it) tends to lower price-to-earnings multiples on stocks. Hence, while earnings may increase, stocks may not move much higher once inflation, say above a 3% annualized rate, returns—though we do not suspect that is this year. When inflation does return, investors can often see better returns in small and mid-capitalization stocks (…as they did in the 1970s). In addition, real assets like real estate, gold and commodities often perform well. Overall, investors should not leave markets, just consider new areas of diversification.

Edward M. Gallagher III, Northwestern Mutual

We might be heading into a challenging period of slowing global growth combined with rising inflation (stagflation). That scenario would have a negative effect on global stock prices for a time. Economic reports—jobs, manufacturing, unemployment, core CPI—continue to be a mixed bag, making the Fed’s job even more difficult. There were a couple of bad earnings “misses” during the past few weeks, not due to sales, but to increased input costs that in turn compressed profit margins. A result of creeping inflation. Historically inflation reduces purchasing power, fewer goods are purchased, which impacts production, revenues and earnings—and in the short run the economy slows down—until the consumer and corporate America become acclimated to the new environment. So we would expect short-term downward pressure on stock prices. These economic cycles can contribute to the earlier point of why the markets always have volatility.

Win Smathers, Shorebridge Wealth Management

Stocks generally are considered a good hedge against inflation, especially over a full cycle. But during periods when the rate of inflation is rising, say from 2% to 4%, different forces compete. Input costs usually rise faster than revenues, thus earnings growth lags. The Federal Reserve raises rates aggressively to bring inflation under control, raising borrowing costs as it attempts to slow the economy. Higher interest rates make bond yields look relatively more attractive and the P/E of the stock market falls to keep stocks competitive with bonds. Whether stock prices fall outright or not depends on the magnitude and pace of these changes, but undoubtedly, stock increases become much more challenging.

Robert Y. Kopf Jr., Smithfield Trust Company

This question presupposes (probably correctly, but not necessarily so) that there will be higher inflation. While there are inflationary forces at work in our economy like wage inflation, there are also countervailing deflationary factors to consider like downward pressures on commodity prices. The net effect of these counterbalancing forces will, we think, be a muted and tolerable inflation. If we are correct in this belief, we do not expect inflation to be a drag on the prices of domestic equities.