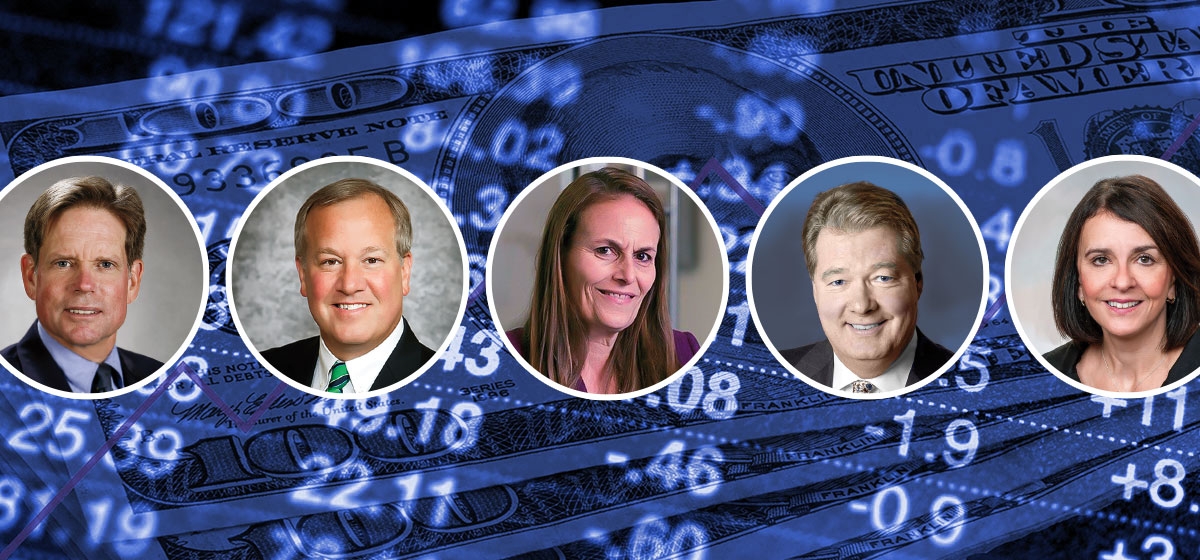

Three Questions on the Markets, Part III

Each year in our Summer issue, we ask a group of the region’s leading financial experts to help our readers by responding to a series of questions. Below is part three of this four-part series with their answers to this question: Do you think the Trump Administration’s stimulus efforts—especially the tax cuts and regulatory reform—will have any long-term effect on U.S. economic growth?

Do you think the Trump Administration’s stimulus efforts—especially the tax cuts and regulatory reform—will have any long-term effect on U.S. economic growth?

James Armstrong, Henry H. Armstrong Associates

The new tax cuts are a form of economic stimulus, and may have short-term growth effects. But a countervailing force occurs as interest rates presently rise. And both of these forces—lower tax revenue paid to the government, and higher interest costs to service the huge debts borrowed by the government—may result in larger federal deficits in the long term. If so, the larger deficits could put the brakes on U.S. economic growth over the long term.

Thomas L. Wentling Jr., Wentling Tarquinio Loughney Wealth Consulting Group, UBS Financial Services Inc.

The $1.3 trillion 2019 budget will take some steam out of the beneficial effects of the 2018 tax cuts, as government spending must be paid for either by taxes or borrowing from the private sector, notwithstanding the simulative effects of increased spending. When you raise the cost of something you want (economic growth), you get less of it. The Federal Register had over 95,000 pages of regulations at the end of 2016. Regulations are in effect a tax as well, since they divert time away from business to comprehend them and money to lawyers to ensure compliance. Tax cuts, regulatory reform and a possible incipient increase in productivity could lift real economic growth above the status quo over the next several years.

John Augustine, Huntington Bank

We do. Our economist, George Mokrzan, has been seeing a noticeable pick-up in corporate capital spending since late 2016, and expects that amount of spending to accelerate in 2018 as a result of the tax legislation. The more we see growth in capital spending by business, the longer this economic expansion can last. Lower regulation is also a boost to long-term economic growth, but may be more narrow in its focus.

Peter F. Mathieson, Fairview Capital Investment Management

We think the stimulus efforts and regulatory relief of the current administration has led to a pickup in overall consumer confidence and an uptick in both job creations and economic growth expectations. Longer term, we are concerned that the rising ratio of Federal debt to GNP, along with the widening Federal budget deficits could lead to a systemic increase in interest rates that could limit future economic growth.

Elizabeth Genter, Schenley Capital

The reduction in the corporate tax should boost the economy short term, although the longer-term impact is questionable. The 2017 Tax Bill slashes the corporate tax rate to 21% from 35%. The larger question is whether this cut will stimulate long-term growth. Ordinarily, lowering of the corporate tax rate should stimulate the economy by increasing work, corporate savings and investment and by stimulating innovation. Near term we should see corporations invest in new plant and equipment and possibly increasing dividends thereby passing this tax savings onto the shareholders. Reducing marginal tax rates on business should lead corporations to consider relocating foreign operations to the US. The long-run effects of tax policies could be either positive or negative depending the resulting impacts on saving and investment outweigh the potential drag from increased deficits.

Robert Y. Kopf Jr., Smithfield Trust Company

We believe that the stimulus efforts of the Trump Administration will have a modestly positive effect on our long-term economic growth. However, for these efforts to have a significant long-term positive effect, they must be coupled with productivity gains and a reform of federal entitlement spending. This coupling does not appear to be likely at this time. As a result, the corporate-directed tax cuts and regulatory reforms will have a more muted effect than one, unfortunately, might have anticipated.

Gregory Curtis, Greycourt & Co.

Certainly the stimulus efforts will have—and already have had—a short-term impact on GDP growth. Whether the effect will persist longer term depends on many factors, including especially whether economic actors continue to feel positively about the future. Positive sentiment is affected by economic issues, of course: Are more people working? Are they confident that their jobs won’t go away? But sentiment can also be affected by other kinds of issues: chaos in Washington, worries about war with North Korea or Iran, concerns about a possible trade war. It’s also important to keep in mind that the US isn’t an island—if growth slows in China, Europe and/or the emerging markets, that will slow US economic growth.

Henry S. Beukema III, Guyasuta Investment Advisors

The Trump tax cuts and regulatory reform are helping to generate accelerated earnings growth. This is positive for the equity markets, which can create a wealth effect that is positive for the economy. With lower tax rates, companies can utilize the increased cash flow to invest in new manufacturing plants and increase hiring, which could accelerate economic growth. However, this could also add to inflation pressures, which could result in the Federal Reserve becoming more hawkish with respect to interest rate increases. Long term, GDP growth is a function of the growth in the number of workers plus the growth in real output per worker (productivity). Tax cuts can help accelerate economic growth but to sustain the growth, the U.S. requires higher productivity.

Michael R. Foster, BNY Mellon Wealth Management

Yes, both deregulation and tax cuts will have an impact on growth but the benefits will be front-end loaded. Regulatory reform gets less headline attention, but should have significant positive impact on capital investment, hiring and business growth. The tax cuts, especially on the corporate side, also have immediate and permanent benefits as companies have more capital to reinvest in their businesses. While stimulative in the near term, tax benefits as well as a $1.3 trillion spending bill will need to be funded by issuing government debt, which will put upward pressure on rates and have the potential to dampen the pace of economic growth a few years out.

Thomas E. Crowley, KeyBank

Taxes and the expense of meeting regulatory requirements are typically meaningful costs of businesses. To the extent that the government significantly and permanently reduces those costs, businesses are more likely to build new operations or expand existing ones.

Politicians on both sides of the aisle have acknowledged that the reduction in corporate tax rates brings the United States into better alignment with the rest of the world. That improves the odds corporate rates will remain lower. That improved profitability increases the odds that business activity will strengthen in the future. Regulatory policy, on the other hand, depends more heavily on the person and party who control the White House. Businesses have responded to regulatory easing in recent months, decision makers know that could change again. For now, reduced regulation should encourage growth, but the current easing will likely have fewer long-term effects on economic growth.

Linda Duessel, Federated Investors

Yes, but the effects could work in opposite ways. On the one hand, regulatory relief and tax cuts can reawaken animal spirits that have been in hiding since the financial crisis. This could ramp up growth as businesses and consumers spend more on hiring, expansion, acquisitions, housing, big-ticket durables, etc. On the other hand, this also could fan inflation, prompting a Fed overreaction that results in recession. Furthermore, the $1.5 trillion-over-10-years stimulus price tag substantially adds to already disturbingly high U.S. public debt. If the Treasury as a result is forced to raise rates higher to lure buyers, it could choke off growth, negating the benefits from stimulus. Finally, there are good reasons for some regulations, making for negative consequences if they are abolished pell-mell.

H. Scott Cunningham, PNC Wealth Management

In the long run, earnings growth has been the number one driver of stock market returns. The less money spent on taxes and conforming to regulations means more money can be spent on growing earnings. In 2018 most analysts are predicting the S&P 500 earnings growth to increase from 12.4% to 19.4% due to tax reform and deregulation. While this will provide an immediate boost to companies and the stock market, it will also have a compounding effect as companies have more cash flow to spend on hiring more employees and investing in growth in the years going forward.

Kim Craig, F.N.B. Wealth Management

While it is difficult to forecast the long-term effects of stimulus efforts, they are likely to pave the way for short-term economic growth. Even though we are in the late stages of the business cycle, tax cuts, regulatory reform and other actions may enable economic expansion to continue for perhaps another two years. The tax cuts will have a particular impact as corporations use the resulting windfall to fund capacity expansion as well as increased compensation, stock buybacks and dividends. Organizations are likely to also experience meaningful increases relative to earnings and profitability. Combined with heightened confidence from the business community overall, these factors may collectively lead to accelerated capital expenditures, increased manufacturing activity and, as a result, job growth and broader economic expansion.