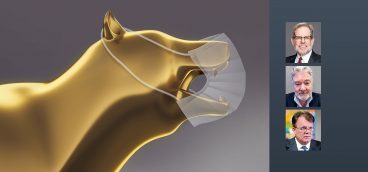

Rough Ride for Markets

Editor’s note: Pittsburgh Quarterly asked regional financial experts to respond to two questions, one about effects on the economy of the war in Ukraine and the other of the effects Federal Reserve actions (or inaction). Many of their answers to the first question are below, followed by the second question and many of their answers to it. More answers will be published on pittsburghquarterly.com.

Q: The Russian invasion of Ukraine has further increased energy and food prices and disrupted supply lines for key manufacturing inputs. What are the implications for the global and U.S. economies?

GREG CURTIS, GREYCOURT

Unless the war in Ukraine ends very soon, the consequences for the global economy will be dramatic. Inflation was already at 30-year highs, but disruption of supply chains, especially among commodities and foodstuffs, will drive inflation even higher. Rising costs for food and energy will hit most economies hard, although Europe and the emerging economies will be most affected. On top of that, recession is a real possibility, again especially in Europe and the emerging countries, as oil prices and shortages hit those economies hard. This combination of high inflation and flat or declining GDP threatens the return of “stagflation,” a miserable economic condition not experienced in the U.S. since the 1970s. Under stagflation conditions, high inflation reduces the value of people’s incomes while, at the same time, the economy is weak and people lose their jobs. The last time we had stagflation the condition was only resolved by Paul Volker’s dramatic actions at the U.S. Fed – inflation was tamed, but the U.S. economy fell into not one but two back-to-back recessions.

LINDA DUESSEL, FEDERATED HERMES

The war is a much bigger problem for Europe than the U.S. Russia ranks first, second and third, respectively, in global exports of natural gas, oil and coal. Russia and Ukraine account for 30 percent of the world’s wheat and 18 percent of its corn. And they produce metals for cars, microchips and other critical uses. More ripples for an already crippled global supply chain. But the European impact is huge. The 27 European Union countries get a quarter of their oil and more than 40 percent of their natural gas from Russia. In Germany, those shares are even higher. The situation is nowhere near as dire for the U.S. It exports as much energy as it imports and is far more energy efficient than it used to be—it only takes 6 percent of the oil to produce a unit of GDP than it did in the ’70s and ’80s. Our farmers also produce a range of commodities. So even as higher prices crowd out other consumer expenditures, they generate revenue and income for big segments of our economy. Further, despite record nominal highs, gasoline in real terms is far cheaper than it was in 2008, representing just 2.3 percent of GDP versus 4.3 percent then.

CRAIG FIEDLER, NORTHWESTERN MUTUAL WEALTH MANAGEMENT COMPANY

Following the initial shock of Russia’s invasion, markets responded much as they have at the onset of past geopolitical conflicts. There is typically a sharp response in markets when a conflict begins, but they settle rather quickly and “price in” a new geopolitical, economic orientation. It’s what happened in the conflict between Russia and Georgia in 2008 and Crimea in 2014. We saw hints of that happening in markets recently, though plenty of uncertainty remains around energy prices, fallout from economic sanctions and the potential for escalation. A big question moving forward is whether rising prices tied to geopolitical uncertainty will impact demand and, therefore, put downward pressure on commodity prices.

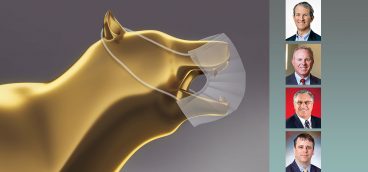

JOHN AUGUSTINE, HUNTINGTON BANK

To us, the Russian invasion story is one of a “commodity superstore” closing, which is having global inflation impacts. The implications for the global and U.S. economies are that if inflation does not move lower in the second half of this year, central banks will likely be forced to take their benchmark interest rates higher, and that would increase recession risks.

ALISON WERTZ, BILL FEW ASSOCIATES

Possibly the end of a golden era of economic globalization. For the past several decades, global companies have been able to source materials and labor from all over the globe and use the cheapest resources available. Additionally, they used a just-in-time inventory mentality to lower cost and increase profits and efficiency year after year. If global companies need to ensure they have adequate supplies from safe sources and can rely on alternative sources, if necessary, global growth could slow for the foreseeable future.

JONATHAN DANE, DEFIANT CAPITAL GROUP

The ultimate spillover effects from the Russia/Ukraine war remain to be seen, but globalization and decentralization, key ideas that drove companies and economies to expand operations around the world after World War II, are facing their greatest challenge in a century. Global supply networks, especially around natural resources, have been shuttered and will need to be reoriented in the coming years. All of which is to say energy prices are likely to remain elevated near term and global growth will be challenged to maintain its post-COVID pace. That said, in the U.S. the economic impact from Russia/Ukraine appears to be less severe, as aside from the impact of energy prices, the U.S. is largely insulated from much of the economic headwinds that Europe is facing. In our view this should help sustain growth in the U.S. economy and limits the probability of a near-term recession.

DOUG STIRLING, STIRLING WEALTH MANAGEMENT AT JANNEY MONTGOMERY SCOTT, LLC

We have been bullish on the energy sector for quite some time and the Ukrainian crisis is magnifying the importance of traditional oil and gas producers. Europe is looking to diversify away from its heavy reliance on Russian oil and gas, which implies further long-term opportunities for U.S. oil and gas firms. We were also bullish on North American natural gas as a bridge fuel toward a clean energy future and this thesis now gains the theme of providing more natural gas to Europe in the coming years. This crisis will also magnify the importance of the transition to a clean energy future. We were already bullish on the need for significant base metals, particularly copper, for the transition to clean energy. The crisis will likely accelerate the clean energy buildout, especially in Europe, with end users diversifying away from Russian base metal producers. Given that it takes years and significant investment to bring on new production, existing U.S.-based metal producers should see near-term benefits from higher demand and prices.

Importantly, a deep recession in their economies is unlikely to have a major impact on global economic growth because Russia and Ukraine together only account for about 1.9 percent of the global economy. We see a limited impact from the announcements from many U.S.-based companies that are discontinuing Russian operations. Russian sales range from 1 percent to 8 percent for the U.S. multinationals with the greatest Russian exposure. This should ultimately have a minor impact on overall stock market earnings.

Ukraine is a major supplier of neon, while Russia is a major supplier of palladium and nickel. Disruption in supplies of these essential components for semiconductor manufacturing could exacerbate the global chip shortages. This would prolong the supply-chain problems and associated inflationary pressures.

Traditional defense spending is also an obvious beneficiary of the crisis, while cybersecurity is a long-term secular theme that we have been bullish on for years. Russia is well known as a cybersecurity threat and this crisis will further emphasize the importance of cybersecurity for all aspects of the economy.

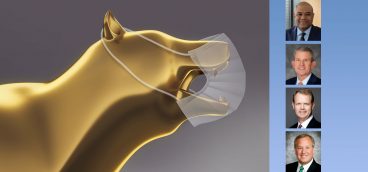

DAVID BUCKISO, FIRST COMMONWEALTH BANK

We were experiencing inflation prior to the conflict in Ukraine as a result of the pandemic. The amount of stimulus, higher demand as the pandemic eased and supply chain disruptions were a 2021 phenomenon. In fact, we did not believe inflation would be transitory as indicated in 2021. The Russian invasion of Ukraine has exacerbated inflationary pressures as a result of higher oil and food prices and further supply-chain disruption. We believe the U.S. economy will remain the world’s strongest economy for the foreseeable future, but will slow in the face of rising interest rates.

BILL WINKELER, CONFLUENCE FINANCIAL PARTNERS

Direct implications are well known — Russia and Ukraine’s economic output and financial markets are very small relative to the rest of the world. Additionally, Western financial institutions had been pulling back banking exposure to both countries. The impact on supply chains is potentially more significant — the energy, food, fertilizer, and rare earth element production by Russia and Ukraine is material. Consumers globally have already felt the pinch, particularly with sharp increases of energy prices, which came during the winter and at a time when prevailing inflation was already near 40-year highs. The ultimate economic response to elevated inflation and any implications for monetary policy as a result are the main questions that need to be answered. As it stands today, the global economy has handled the unexpected increase in energy/commodity prices and inflation relatively well. The Federal Reserve has, in turn, reacted by shifting policy to a more restrictive stance, implications of which are still being digested.

MYAH MOORE IRICK, THE IRICK GROUP, MERRILL PRIVATE WEALTH MANAGEMENT

Despite relatively small economies, Russia and Ukraine are major exporters of critically important commodities. Therefore, the conflict has created a ripple effect of risks globally. Even assuming a diplomatic solution eventually unfolds, a drawn-out conflict could be negative for economic growth prospects. Oil prices, in particular, have become increasingly oppressive for consumers around the world and could exacerbate an already elevated inflation environment. Europe is particularly at risk because of its disproportionately large dependence on Russian oil and an already tight global energy market. The U.S. is in a much better position to weather the energy crisis.

There are implications to global economies. In addition to a sustained inflationary environment, shrunken energy supplies could lead to the acceleration of the global energy transition, with an even greater urgency to secure supplies of traditional energy sources and to lock in renewable alternatives. It is a good time to look at impact investing and the opportunities in renewables.

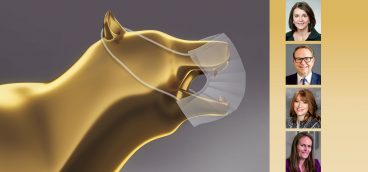

Q:Inflation has proven to be higher and “stickier” than the Fed expected. Do you think the Fed’s policies are appropriate or is the Fed behind the curve? What is your best estimate for inflation at the end of 2022?

JAMES ARMSTRONG, HENRY ARMSTRONG ASSOCIATES

The Fed is probably behind where it should be in fighting inflation. However, some of that inflation was driven by an unpredictable COVID pandemic, followed by an unpredictable medical response, followed by Russian’s surprise invasion of Ukraine. The Fed is necessary and effective. However, we should not expect them to be able to see around corners and we must realize the limits of their capabilities. The business cycle has not been repealed. We cannot expect the Fed to immunize us from inevitable booms and busts. Instead, we should prepare our affairs and our portfolios to survive such cycles — we should not attempt to precisely predict them and expect that we can avoid them. Economic predictions may fill airtime on television, but they have virtually no utility in actually investing well, making profits, and minimizing losses in a portfolio.

GEORGE MATEYO, KEY PRIVATE BANK

The Fed has been behind the curve, but it pivoted hard in November in the face of the Omicron variant. That was significant because it told us the Fed was serious about addressing inflation. This seriousness was tested again once the situation in Ukraine worsened, but again, the Fed has reiterated its resolve and has turned even more hawkish. In fact, the Fed seems to be suggesting it will tighten more than the market anticipates. This could prove necessary if inflation is higher for longer, but the outlook for inflation is incredibly uncertain and it would probably have to recede quickly for the Fed to abandon its tightening campaign.

MICHAEL R. FOSTER, J.P. MORGAN PRIVATE BANK

We feel that the Fed is on the right track – data dependent, agile and as transparent as ever. Rumblings of tighter policy emerged late last year, and the hawkishness of the Fed appropriately increased as new data came forth in the first quarter of 2022. Remember, the Fed’s job has always been tricky, and this cycle may be the most complex yet – it is not a perfect science. However, in the U.S., while expectations for near-term inflation have rocketed, longer-dated measures remain more reasonable. For instance, American consumers expect inflation over the next three years to be notably lower vs. one year ahead. This suggests that they believe they can weather the storm of higher prices — an important point for those worried about a wage-price spiral. Our base case in which the Fed is able to “land the plane” on normalized inflation without driving the economy into recession has become increasingly more complex. We believe the Fed can do it, but it will need to steer carefully and remain agile. We expect inflation at the end of this year to be 4.1 percent in the U.S., dropping to 2.0 percent by year-end 2023.

MATT GEORGE, PNC PRIVATE BANKS

With the jump in short-term interest rates lately, we believe the bond market is flashing warning signals that the Fed may have been too late on high inflation and could be too aggressive with rate hikes. If you look at the drivers of inflation, it’s really two areas: fuel costs and used car parts. We think in the latter case it’s ground zero for supply chain bottlenecks across a number of industries. When used cars are selling for more than new cars you know this is not a normal environment for inflation! Energy prices could be the one area that keeps inflation somewhat elevated — oil production is far from pre-pandemic levels, and Russian sanctions become another tailwind for oil prices. In our view, what could pressure inflation lower is the ongoing labor market recovery. We’re just now finally seeing labor force participation for women recover; the unemployment rate for African Americans as well as Hispanics is just now back to pre-pandemic levels again. When labor markets improve, it means supply chains can normalize and inflation goes down. PNC Economics forecasts CPI will end the year at 6.4 percent — still well above the Fed’s 2 percent target but a notable decline from where it could go in the next few inflation readings.

THOMAS WENTLING, THE WTL GROUP, MORGAN STANLEY

I do believe the Fed is “behind the curve,” as Chairman Powell admitted Nov. 30 of last year in congressional testimony when he retired the word “transitory” describing inflation. The policy reversal since then is pretty dramatic regarding forecast interest rate hikes and balance sheet reductions. When an orthopedic surgeon tells you to take the prescribed painkillers as directed, regardless of whether you feel any pain as the nerve block wears off, and you don’t, you won’t make that mistake a second time. Inflation is very similar. Once you get behind, it requires an enormous effort to get back in front of the pain. We are trapped in a “cost/push” inflation (vs. demand/pull), and reducing the input costs to supply is not an easy riddle to solve. It starts with incentivizing suppliers to supply. As supply increases, more goods chasing existing dollar supplies bids down the cost of those goods, lowering the cost of the inputs to supply, which lowers prices. It’s a long slog, but the longest journey begins with the first step. I cannot forecast inflation by year end, but I do take comfort knowing neither can the Fed.

BETH GENTER, SCHENLEY CAPITAL

We believe that the Fed is behind the curve and waited too long to raise rates. Interest rates are rising quickly for three main reasons: inflation, the Federal Reserve’s decision to raise interest rates a quarter of a point, and the uncertainty of Russia’s war in Ukraine. For example, the annual inflation rate in the U.S. was 7.31 percent for the past six months, the highest since December 1981. The inflation rate in 2020 averaged 1.2 percent; therefore, a significant and swift rise in the rate. We feel the Fed’s policies are appropriate, although a bit slow in increasing rates, as illustrated by the fact that the economy is in good shape and company earnings have been strong for several quarters. We feel that the economy can withstand additional rate hikes this year, because of its strength, although the Fed does need to be careful not to signal too many rate hikes too close together. We predict that inflation will rise to an average of 8.3 percent by the end of the year.

JOSEPH A. SCARPO, CAPTRUST

The Fed faces a very difficult task. Even in a normal economic environment, slowing growth and inflation pressures through tighter policy conditions and higher interest rates, without going too far and triggering a recession, is a delicate balancing act. Not to mention the unique conditions of recovering from a global pandemic and the current war in Ukraine. In addition to interest rate hikes, the Fed will have another tool that has not been tested at this scale — so-called quantitative tightening or shrinking the size of its enormous portfolio of bonds purchased during the crisis. Markets are rightly wary and anxious of the risks of a policy mistake. Because we are entering unknown territory with the combination of Fed actions and what is going on in the world, it is difficult to predict where inflation will be at the end of the year.

WIN SMATHERS, SHOREBRIDGE WEALTH MANAGEMENT

In March the Fed started its campaign to return to normal monetary policy by raising rates for the first time since 2018. In addition, the Fed’s pandemic bond purchase program in Treasuries and agency mortgages will conclude by summertime. Perhaps the Fed was a little late in its response to the reopening of the post-pandemic economy where demand has skyrocketed while supply remains constrained. The bottom line is, rates are heading higher but the flattening shape of the yield curve is telling investors that economic slowdown is now a real risk. With inflation at levels not seen since the early 1980s, the Fed is expected to raise rates aggressively to wrestle back control over prices. We have become accustomed to low inflation and the global central banks will endeavor to see a return to these times, but I worry that prices will rise further and remain for longer than most anticipate. It’s quite possible that inflation hits double digits by year end with continued supply chain problems due to China’s manufacturing hub cities being on COVID lockdown and no relief in energy, food and commodity pricing on the horizon.

PETER MATHIESON, FAIRVIEW CAPITAL

We believe the Fed has been behind the curve for quite some time. We expect a more aggressive course of action with a likely scenario putting the U.S. economy into a recession. The unprecedented rise in the money supply will take several years to work itself out, resulting in rising inflationary pressures throughout the year. As of this writing, the current annualized inflation rate is 7.9 percent and we feel it will be at least that high at the end of the year.

ROBERT KOPF JR., SMITHFIELD TRUST COMPANY

The Pittsburgh Quarterly is correct in pointing out that the Federal Reserve’s prior characterization of inflation as “transitory” was clearly wrong, and the Fed needs to take swift corrective action in raising rates. We are definitely “behind the curve.” As we have seen, Fed Chairman Paul Volcker in the early 1980s raised rates aggressively, and these draconian efforts led to a recession. We acknowledge that the Fed has a tough balancing act under current circumstances. Interestingly, even the most “dovish” members of the Fed are moving away from accommodative monetary policy. It remains to be seen if this new stance dampens economic growth excessively. We estimate that the annual rate of inflation at the end of 2022 could be as high as 7.5 percent.

MALCOLM E. POLLEY, STEWART CAPITAL

The Fed is almost always behind the curve. The market typically begins the process, through the yield curve, of signaling when the Fed should modify monetary policy. While the Fed often tries to engineer an economic “soft landing,” it almost never succeeds. The current cycle should be no different. Given the significant amount of liquidity injected into the economy to combat the COVID recession, the Fed should have begun unwinding its balance sheet and hiking interest rates earlier. As a result, the Fed will likely need to be more aggressive than they otherwise needed to be had they begun this process earlier. We believe that inflation should decline through the year, ending the year closer to 4 percent.