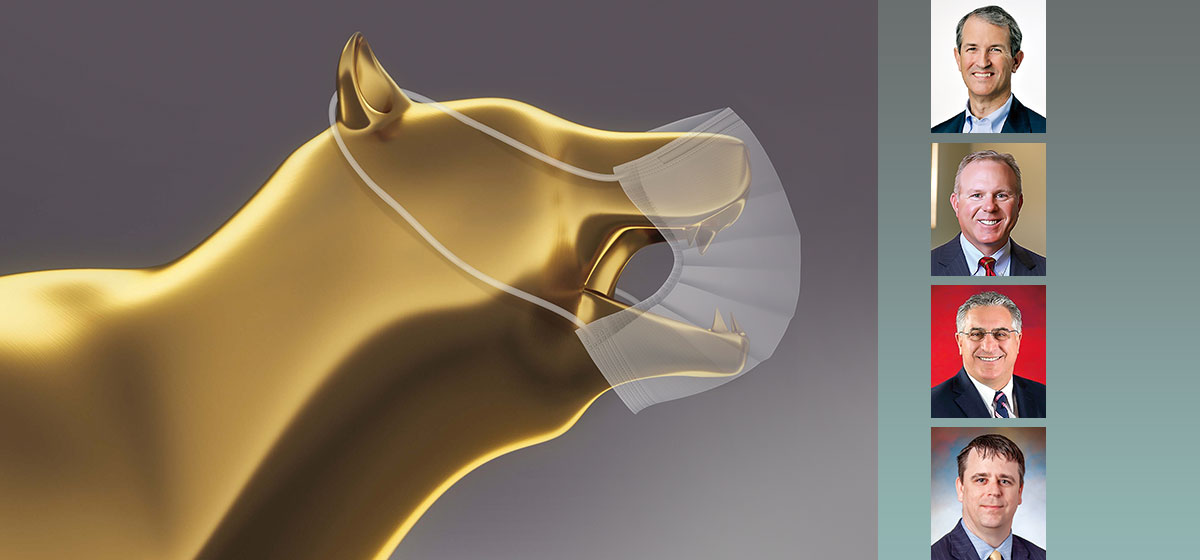

Positioning Client Portfolios: Fairview Capital, Shorebridge, PWA, WesBanco

Each year in the summer issue, we ask a group of Pittsburgh’s leading investment experts to answer a question for our readers in 250 words or less. This year’s question: “The coronavirus has led to the first bear market in more than a decade with widespread uncertainty remaining. How are you positioning your client portfolios in this fraught environment?”

Peter F. Mathieson, Fairview Capital

The current period has been notable for the speed of both the market correction and subsequent sharp recovery. Like previous bear markets, the current environment is characterized by a very high degree of volatility as security prices have swung dramatically in both directions. As we learned from past market disruptions, the optionality of holding cash becomes quite valuable during volatile periods; for our newer clients with high cash positions we are putting this cash to work very slowly and in modest increments. It is impossible to call the bottom of a bear market but it is possible, and desirable, to slowly invest in high quality companies as share prices drop.

Given our commitment to and considerable investment in researching individual companies, we have always been drawn to owning companies with proven competitive advantages, excellent management teams and rock solid balance sheets. Understanding complex balance sheets is critical during periods of considerable economic turmoil. When appropriate, we are looking to increase exposure to companies that have both modest debt levels and also a high degree of liquidity on the balance sheet. With the ten-year Treasury note currently trading at less than a 1 percent yield, stocks have become a critical source of income for our clients in retirement. We are favoring companies with a high level of free cash flow consistency and also a long history of dividend growth and stability.

Win Smathers, Shorebridge Wealth Management

Our goal is to have client portfolios prepared for this type of market event prior to 2020. As Casey Stengel said, “The best time to think about losing is when you’re winning.” As such, over the past few years, we have discussed risk with our clients, not in terms of percentages, but in terms of years. How many years can you go without having to sell your equities? That is a critical question that is proving to be of significant importance as the uncertainty continues to unroll. For those who have found themselves with income disruption, we are addressing their liquidity needs personally to account for these unusual circumstances. Beyond that, we are taking this time to revisit our target allocations for clients and having discussions about rebalancing if their asset allocation guidelines call for it. Bear markets afford long-term investors the opportunity to pull weeds and plant flowers. Thus, we have revisited every position in our client portfolios to see where improvements can be made to render some benefits for our clients during a tumultuous market. Our goals are to help our clients make the most of what may be considered a buying opportunity for those who have the ability to take advantage while doing all we can to take care of those who have been less fortunate through the crisis. Our lives may take a while to return to normal, but rest assured that capitalism works. The great companies of America and the world will thrive again.

Joseph A. Scarpo, PWA Wealth Management

PWA Wealth Management has a customized plan for every client. Since every client has a Goal Policy Statement, a GPS, they are equipped with a dynamic navigation system that anticipates the detours that occur along any financial journey. In times of extreme volatility, fixed income positions secure the income needs of our clients, enabling us to focus on the long-term equity side. In the current environment, we see the greatest investment opportunity in growth companies with strong balance sheets. We choose to avoid the emerging markets and non-U.S. investments, as the probability of significant and more rapid economic recovery exists in the United States in comparison to the rest of the globe.

We recognize that we are in fully uncharted waters. This bear market is different than those experienced in 2000–2003 and 2008–2009. The economy is impacted at every level. The federal debt has exploded. State and local government revenue is dramatically reduced. Individual debt levels as a percent of income have expanded. Yet, the United States has been the greatest economic engine the world has ever seen. We believe this phenomenon will be repeated as we work through the current economic disaster. Coming out of this pandemic, there will be investment opportunities. The criteria may become more stringent—more selective—but there will be companies whose value propositions are rock solid. PWA is constantly studying and evaluating these opportunities on behalf of our clients.

Scott Love, WesBanco Trust and Investment Services

As part of our disciplined investment approach, we review best and worst case scenarios with clients to insure that their risk tolerance captures those extreme cases before constructing investment solutions. In addition, we review the likelihood that these types of events will occur during their investment time horizon. As a result, many of our clients are prepared for corrections of this magnitude. Still, over the past several months, investor emotions have swung from “fear” to “FOMO” when discussing the volatility of equity markets. With wide equity market swings, many investors are thinking, “Don’t stand there, do something,” when the best course of action is to “not do anything, but just stand there.” Our best practice involves examining these types of portfolio corrections, and the last thing investors should do is change plans during a steep correction.

While we have seen seven major virus outbreaks over the past 27 years, the global magnitude of the shelter-in-place orders has slowed growth rates in excess to those posted in the 2008–2009 Recession. Our investment team is reviewing these periods, and other periods of economic slowdown to gauge the potential downside. In addition, our team has decades of collective knowledge and access to a number of highly qualified experts. We are marshalling all of our resources and intellectual horsepower to make sure that clients are properly positioned for the eventual recovery. We continue to believe that we will get through this recent set of events and emerge stronger on the other side.