How to Handle the FAANGs

“Consumers won’t thank antitrust enforcers for repeating the mistakes of the past.” —Jessica Melugin, Competitive Enterprise Institute Previously in this series: “Laissez-Faire vs. the Progressives: Antitrust Is More Interesting Than You Think, Part IX” The so-called Chicago School approach to antitrust enforcement has many fathers and they rarely agree on much. In addition, the school …

Laissez-Faire vs. the Progressives

From the date of enactment of the first antitrust laws during the Roman Republic right up to the present moment, there have really been only three theories that have addressed the proper role of a government in controlling anticompetitive behavior. Previously in this series: “Government Missteps: Antitrust Is More Interesting Than You Think, Part VIII” …

Government Missteps: Let Me Count the Ways

By the mid-twentieth century, antitrust enforcement in the United States had become far more sophisticated than it had been for the first six decades after the Sherman Act was passed in 1890. Unfortunately, the ratio of success-to-fiasco remained roughly constant. Previously in this series: “The Weird Inconsistencies of Trust Busting: Antitrust Is More Interesting Than …

On Inflation

So many people have asked about my views on inflation that I’m pausing my antitrust series to address the topic. Back to antitrust next week. “If [Biden] succeeds, the President will cast 40 years of economic doctrine on history’s ash heap. But that’s a big if.” — Michael Hirsh, in Foreign Policy In my day …

The Weird Inconsistencies of Trust Busting

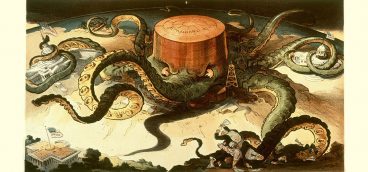

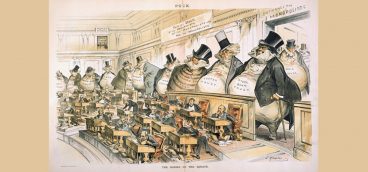

Last week, I suggested that the enforcement of America’s antitrust laws has made little sense since the Sherman Act was adopted in 1890. In fact, the word that comes to mind is “fiasco.” Previously in this series: “Making Monopoly Illegal: Antitrust Is More Interesting Than You Think, Part VI” I mentioned earlier in this series …

Making Monopoly Illegal

When people who don’t like free markets (i.e., almost everybody in academia) talk about antitrust law, they almost always begin by saying something like this: “One of the core defects of market economies is the inevitability of monopolistic practices.” Previously in this series: “The Tricks of the Trade: Antitrust Is More Interesting Than You Think, …

The Tricks of the Trade

The plaintiff’s law firm wanted to impress their client with how important the case was to them, and so there were never fewer than five lawyers at the plaintiff’s table. Plus, of course, the plaintiff himself. Previously in this series: “Fighting the ‘Big’ New York Law Firm: Antitrust Is More Interesting Than You Think, Part …

Fighting the “Big” New York Law Firm

Here are more vignettes to show you what it was like to try a case — a big case — with Mr. W, the senior Reed Smith partner who looked terrific but whose elevator didn’t seem to go all the way to the top floor. After that I’ll return to my original topic: “Antitrust Is …

How Was I Supposed to Know?

Mr. W was mostly trying other cases during the week, so we prepared for Big Steel v. Bigger Steel on weekends. Every Saturday and Sunday morning, I would stroll into the Reed Smith conference room at precisely 9 a.m., and every Saturday and Sunday morning, Mr. W would look up at me and say, “Dear …

Me and Mr. W

After I posted last week’s blog, a large number of people wrote in to ask how the private antitrust case turned out: Did I actually get eaten by rats? Did the case go to trial or settle? Did we win or lose? Previously in this series: “Antitrust Is More Interesting Than You Think” Your Humble …

Antitrust Is More Interesting Than You Think

When I was a 3L, that is, a third-year law student, I — like every other 3L — spent half my time studying dismal areas of the law and half my time interviewing with law firms for permanent legal jobs. One of the firms I was interested in was Cravath, Swain & Moore. (Cravath, by …

The Dramatic Conclusion

Professor H was a formidable, brilliant, intimidating and impossibly rude professor, and I’m sure he was the model for the notorious Prof. Kingsfield in the movie “The Paper Chase” (which was about Harvard Law). Previously in this series: “The Senator’s Big Idea: Joe Biden Saved Me from Pocatello, Part III” Under normal circumstances, I’d never …

The Senator’s Big Idea

Joe Biden was my new client because he’d called Joseph Hill Associates to ask about something called “federal revenue sharing” (FRS). Most people live long and happy lives without ever hearing that phrase, but, alas, not me. I was JHA’s resident expert on FRS. Previously in this series: “The Law Works in Mysterious Ways: Joe …

The Law Works in Mysterious Ways

After I was mustered out of the army, I reapplied to law school to finish my second and third years. I assumed my readmission would be pretty much automatic, but I was wrong — I was put through the wringer. Previously in this series: “Joe Biden Saved Me from Pocatello” Eventually I was required to …

Joe Biden Saved Me from Pocatello

I had no intention of going to law school. In fact, I’d already been accepted into a Ph.D. program in English Lit at Yale and fully intended to spend my life writing poetry and teaching literature on some leafy campus. But then I got my draft notice and suddenly I got a lot more realistic …

The Thrilling Conclusion

We now come to the dénouement of my story, with the episode we’ll call The Imposter. On a Saturday evening, I donned my young-lawyer uniform and headed for Glassport, Pa., situs of Copperweld’s headquarters and plants and where I was to stand in for the Baron. Previously in this series: “The Mystery Man: Baron Rothschild …

The Mystery Man

The Case of the Missing Briefs was a disaster that my legal career survived only because it turned out Mr. F didn’t actually need those particular briefs during the argument before the judge. It’s always better to be lucky than smart. Previously in this series: “Whoops! Baron Rothschild and Me, Part IV” But there were …

Whoops!

Before I reach the exciting conclusion of my series on Baron Rothschild, I want to mention just two of the many bizarre events that occurred in connection with Imetal’s attempted takeover of Copperweld Corporation. Previously in this series: “A Strange Request: Baron Rothschild and Me, Part III” Most of those strange events arose out of a …

A Strange Request

My checkered performance during l’Affaire de la Limousine had apparently put me in the Copperweld-Imetal doghouse, because I received no more assignments on that matter for a long time. Previously in this series: “A Humbling Start: Baron Rothschild and Me, Part II” I’d nearly forgotten about the takeover when I received a call from the …

A Humbling Start

As I entered the huge corner suite occupied by the head of the litigation group, I strolled by his secretary’s desk saying, “I assume he’s expecting me.” Previously in this series: “Baron Rothschild and Me” “Not likely,” she said. “He’s in New York.” I stopped dead. “But…” I stammered. “He doesn’t want you — I …

Baron Rothschild and Me

I had passed the bar exam and was working for a very large law firm in Pittsburgh. I was still so new I would get lost on my way to the men’s room. But it was wildly exciting for a working class kid from a dying mill town to be associated with such a prestigious …

How Sharpe Is Your Ratio?

“The Sharpe ratio is oversold.” — William F. Sharpe If the Sharpe ratio didn’t exist, I swear the financial industry would have to shut down. Originally developed by William F. Sharpe in the 1960s, he called it the “reward-to-variability ratio.” Sharpe first described the ratio in a paper published in the Journal of Business in …