The Perils of Fed Speak

“Our regulators are proving worse than the Bourbons: they have learnt nothing and forgotten everything.” — Martin Sandbu, Financial Times, quoting Talleyrand

Previously in this series: Can the Fed be Saved?

For nearly three decades the U.S. Fed has followed easy money policies regardless of economic conditions, giving birth to a series of economic crises unlike any the U.S. economy has known. How could such a thing have happened?

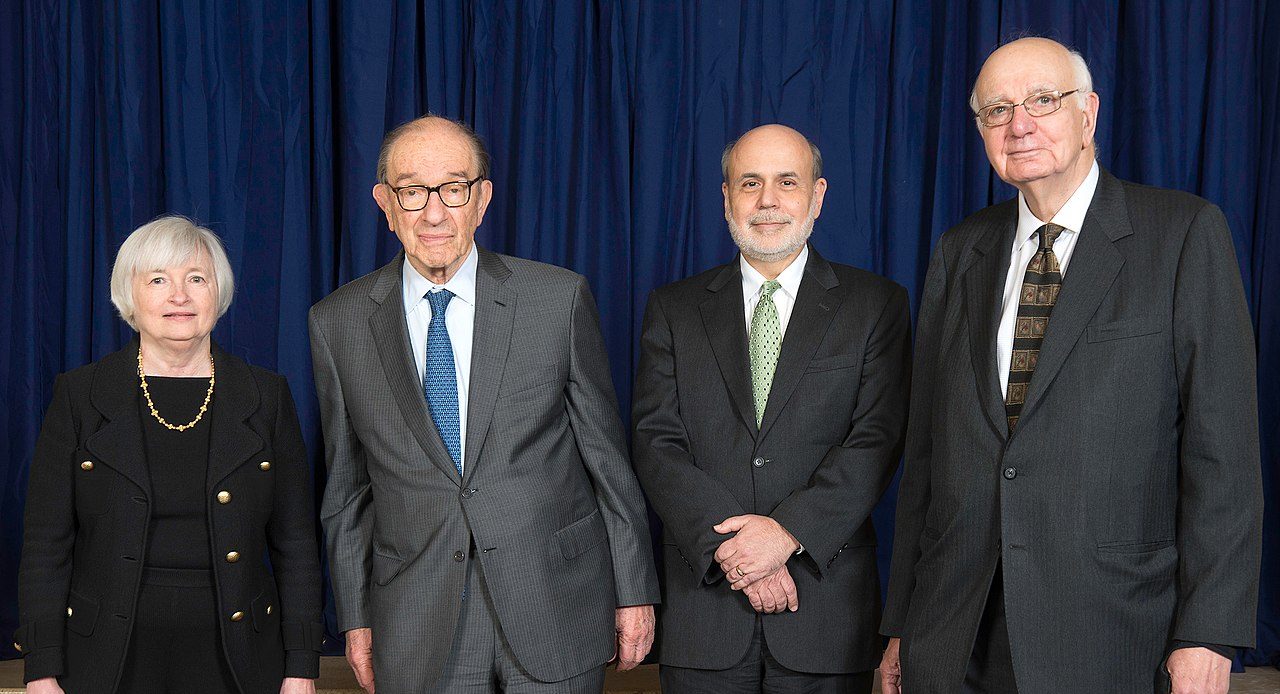

It’s not because we’ve had a series of four incompetent Fed chairs in a row. Greenspan, Bernanke, Yellen and Powell have all been thoughtful professionals with long and successful careers behind them. They aren’t adherents to weird economic ideas and they aren’t ideologues.

So what gives? Here are a few suggestions:

Groupthink

Virtually every thoughtful person who has examined the U.S. Fed – and, for that matter, central bankers globally – has remarked on the uncanny unanimity of the thinking that goes on in the fraternity. Voting members at the Fed almost always vote unanimously, and no matter how wrongheaded the Fed’s policies are, even when the Fed itself admits they were wrong, those policies were always approved unanimously.

This sort of bland intellectual homogeneity is almost unknown outside, say, North Korea, but it is alive and well at the Fed. Why? Perhaps because every Fed economist, from the rawest newbie to the voting members of the Open Market Committee, went to the same universities, studied the same subjects, had the same professors. They read the same publications, watch the same cable news channels, live in the same neighborhoods. They don’t consort with anyone but people just like themselves.

However smart these people are as individuals, this is a very bad way to conduct economic policy. The Fed desperately needs to increase its intellectual diversity, even if it has to engage in some sort of econometric affirmative action.

Lack of accountability

No matter how badly the Fed screws up, no matter how much damage is done to the U.S. and global economy, no matter how much American competitiveness is undermined, there are no consequences. It’s virtually impossible to remove Fed board members and the absolute worst that can happen is that a Fed chair’s term isn’t renewed.

No one wants to see a highly politicized Fed, but a completely unaccountable Fed ought to be equally unacceptable. The Fed reports to Congress, so it should be relatively easy for Congress to create an oversight or advisory committee on economic policy. By appointing members to this group from across the political spectrum and across the intellectual breadth of the economics profession, the committee could demand explanations for damaging policies, quantify the damage, recommend different approaches, hold the Fed’s feet to the fire, and in general let the Fed know that it will be held publicly accountable for its failures.

Short-termism

Short-term thinking is a problem across America and the world, but it’s a way of life for the Fed. From its forward guidance to its dot plots to the economic projections of the FOMC participants, the Fed seems congenitally unable to consider the longer-term consequences of its actions. This inevitably results in a kind of institutional infantilism, a preference for short-term gratification – feel-good, easy money policies – even if those policies are certain to lead to longer term calamity.

Cluelessness

When you go to work for the Fed you leave your common sense out on the sidewalk. Consider the swift collapse of Silicon Valley Bank and Signature Bank, which happened because depositors rapidly withdrew their cash while our Federal regulators were looking elsewhere.

When the folks at the Fed imagined a bank run they apparently envisioned long lines of anxious depositors stretching from the bank doors around the block – with maybe George Bailey (James Stewart) gamely trying to stem the flow, as in It’s a Wonderful Life.

Note to Fed: nobody goes to banks any more. When we want to move money out of our accounts we simply tap on our cellphones and – bingo! – it’s done. Bank runs that used to take days or weeks now happen in minutes. Did the Fed really not understand this?

Or consider the Fed’s pressure on banks – like Silicon Valley Bank – to load up on U.S. Treasury bonds because they have zero default risk. But, hello, default risk isn’t the only risk associated with owning Treasury bonds – it isn’t even the primary risk. The major risk to anyone owning Treasury securities is that a significant rise in interest rates will dramatically reduce the market value of those bonds, and that is exactly what happened in 2022.

As the Fed rapidly increased interest rates to fight inflation, the value of long-term Treasuries dropped 30 percent. Did it really never occur to the Fed that a sudden and rapid increase in rates – orchestrated by the Fed itself – could devastate banks’ capital? As rates rise, bond values decline – it’s Finance 101, guys.

Disingenuousness

Listening to central bankers talk quickly numbs the mind. When the Fed bailed out depositors at Silicon Valley Bank – using our money – Powell and Yellen solemnly assured us that it had to be done to prevent contagion to other banks. When Bernanke bailed out the biggest banks with taxpayer money, we were assured that it was necessary to prevent another Great Depression. When Swiss regulators orchestrated a taxpayer-underwritten merger of Credit Suisse and UBS it was to prevent “an international financial crisis.”

This sort of excuse-making could charitably be described as lying-through-their-teeth, but we’ll just point out that it’s actually central-banker-speak for “We’re in a terrible panic and have no idea what to do.”

Interestingly, Switzerland’s Federal Prosecutor has opened a criminal investigation into the Swiss financial regulators’ conduct. Maybe there will be accountability after all!

Next up: Moonlight Mushrooms