Firing Your Financial Advisor, Part II

If you Google “Should I fire my financial advisor?” you will land on a lot of brain-dead articles. If any of the reasons listed in those articles apply to your financial advisor and you haven’t fired him, you’re probably hopeless.

But in the interest of comprehensiveness, let’s take a quick look at reasons to fire your advisor right now.

(By the way, I’m imaging that your advisor is a guy, since men still overwhelmingly dominate this field—there are four times as many male advisors as there are female advisors. Interestingly, it’s the opposite in Japan, where women outnumber men two-to-one. In the Japanese version of this blog I’ll refer to your advisor as “she.”)

He’s not returning your calls. Okay, financial advisors are busy people and many of them travel almost every week. Still, if they aren’t reasonably responsive that’s a major disqualifying characteristic.

An investor once showed me an email exchange she had had with her (soon to be ex-) financial advisor. She was worried that her existing investment strategy might need to be revised because her parents were getting older, her father had already had a stroke, and she’d recently been notified that she would receive a significant inheritance from her favorite uncle.

She had raised these points at several meetings with her advisor, but he had fluffed off her doubts. After stewing about it over a weekend, she sent her advisor a five-paragraph email outlining her concerns. When she hadn’t heard anything by Wednesday, she forwarded the original email to him, saying, “Can you please get back to me about this?”

Finally, at 4:49 p.m. on Friday she received a reply, which I reproduce here in its full glory: “Got it, thanks.”

You have no idea how much you are paying. Unless you are working with a true open architecture advisor—that is, one who charges you a clearly stated fee and nothing else—it’s almost impossible to know how much your advisor is getting paid. The financial industry is so corrupt, and the compensation arrangements are so (intentionally) obscure that only a forensic accountant can tell you what you’re actually paying. Consider fees, kickbacks, commissions, concessions, servicing fees (12b-1 fees), revenue-sharing payments, soft dollar arrangements, and so on and so on. According to one recent study,* you are probably paying 70% more than you think you’re paying.

Your advisor has three standard portfolio models and he has shoehorned you into one of them. This is an extremely common practice in the financial industry and it is to be avoided like the plague.

You can’t understand a word the guy says. Some advisors use investment jargon because they think it makes them sound smart, while others use jargon because they have no clue what they’re talking about in the first place. In either case, take your money and run. There are no investment issues that are so complex they can’t be explained in simple English prose.

In addition to the painfully obvious reasons why we should fire our advisors, there are a host of other good reasons for terminating them that you won’t typically find by Googling. (That is, until this post is published.)

You’re still with the same advisor you started out with 25 years ago. A lot of families engaged a financial advisor when they were younger and were worried about paying for college. Now, many years later, they are far more affluent, but they are still with the same guy. The financial advisory community is a kind of caste system. There are firms that advise middle income people and who are very good at it. There are firms that advise the mass affluent and who are very good at that. And then there are firms that advise the truly wealthy and they are very good at that (far more complex) activity. If you have moved beyond the core competence of your advisor, you need to make a change before your assets fall to the level of the advisor’s competence.

Your advisor isn’t a fiduciary. The U.S. brokerage industry spent more than $100 million on a vast lobbying, public relations and litigation campaign and succeeded in killing the U.S. Department of Labor’s fiduciary rule. But that doesn’t mean that you can’t “kill” your non-fiduciary advisor. If your advisor isn’t a fiduciary it’s his interests that he’s pursuing, not yours. (Note that there is some chance the SEC will adopt a fiduciary rule by adding the word “fiduciary” to its new “best interest” rule. We’ll see.)

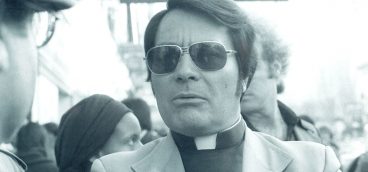

Your advisor claims he’s a fiduciary but really isn’t. The SEC recently raised concerns about a newer phenomenon in the advisory world: so-called “dual-registered” advisors. These folks sometimes wear a white hat as a fiduciary (an RIA), and it’s that hat they roll out when they’re pitching for your business. But they also wear a non-fiduciary black hat (a broker/dealer) and it’s that hat they wear when they are investing your portfolio—so they can feather their own nest. Run the other way.

You’ve decided that your advisor isn’t taking enough risk. This is a good—indeed, exceptionally good—reason not to fire your advisor. Near the end of every bull market investors decide that their risk tolerance is actually a lot higher than they thought it was. They fire their boring old capital-preservation advisors and hire gunslingers. Think of the mid-1960s (just before the Crash of 1966 and the debacle of 1973-74), the late 1990s (just before the Tech Bust of 2000-02), 2006-07 (just before the Global Financial Crisis), and today. Just don’t do it.

Next week we’ll focus on the “when” and “how” aspects of firing your financial advisor.

*“The Total Expense Ratio,” by John A. Haslem, emeritus professor of finance at the Smith Business School at the University of Maryland.

Next up: Firing Your Financial Advisor, Part III