Central Bankers Then and Now, Part III

Scholars of the Great Depression typically blame policymakers of the 1930s for failing to do four things:

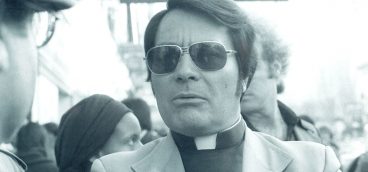

- They failed to rein in the 1920s economic boom, allowing its collapse to lead to the worst depression in US history.

- Following the Crash of ’29, they failed to inject sufficient liquidity into the economy, causing it to contract much faster and more deeply than would otherwise have been the case.

- During the Depression, the U.S. government failed to engage in the massive deficit spending that would have jump-started the failing economy.

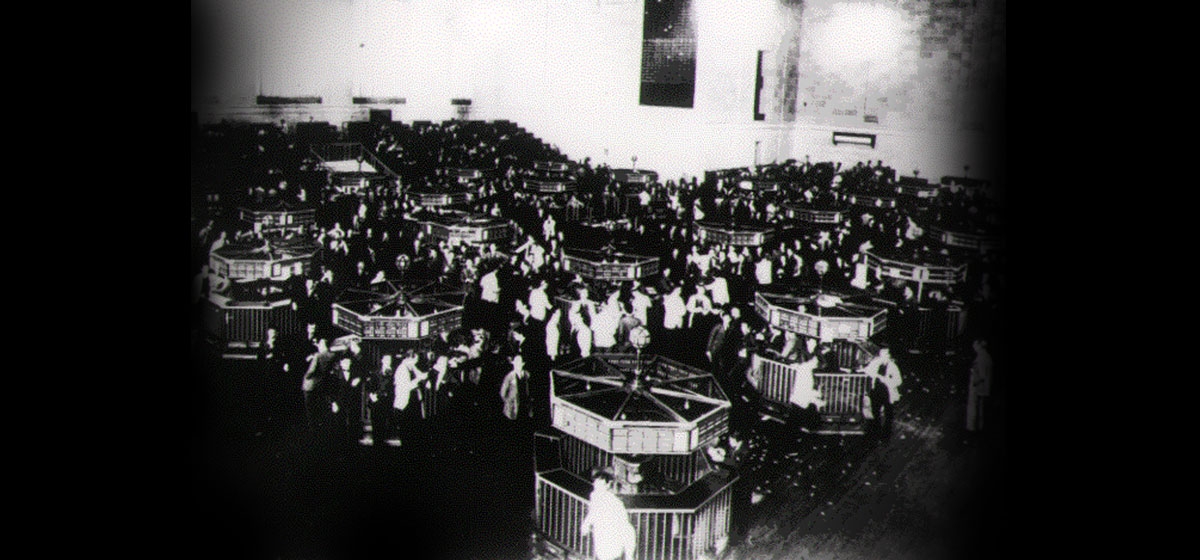

- In the early 1930s, as bank failures rose, the Fed and the Treasury Department failed to act quickly enough to save the banking system, whose collapse prolonged the Depression by many years.

Just by looking back at the facts as I’ve laid them out, some of these critiques are fair and some of them aren’t.

It’s true that policymakers in the 1930s failed to rein in the market boom (rates were actually eased in 1927, in an effort to help a collapsing Germany and a nearly-collapsing Britain). And it’s also true that, once the market crashed and the recession began, central bankers should have been more accommodative. Instead, they initially raised rates, believing that it was better for the economy to keep the dollar strong (it was then pegged to gold) than it was to encourage borrowing. In retrospect, that was a mistake, although at the time it seemed reasonable.

But, given those errors, central bankers in the 1930s did a decent job, growing the economy faster during the Great Depression than modern central bankers have been able to do following the (far less devastating) Great Recession. In addition, and possibly more important, they set the economic stage for the greatest long-term economic boom in American history.

Consider this scenario. Suppose the central bankers of the 1930s had in fact injected massive liquidity into the U.S. economy after the ’29 Crash, as their modern counterparts did following the Financial crisis. And suppose that those early central bankers, like their modern counterparts, had then continued to inject liquidity long after the recession had ended (that is, after 1933 and after 2009). The U.S. economy of that day would have entered into the same prolonged period of “secular stagnation” that we endured after 2008.

If that had happened, what shape would the U.S. have been in when World War II reared its ugly head? With its economy moribund, could the U.S. have geared up sufficiently to fight and win a two-front war against Germany and Japan?

Fortunately for us, and thanks in large part to the restraint shown by the policymakers of the 1930s, by 1940 the U.S. economy was roaring ahead, having grown 63% since the recession ended in 1933. If Ben Bernanke had been running the Fed in the 1930s, our economy would have grown a paltry 9%—that’s how much U.S. GDP grew in the similar period after the Financial Crisis.

I would argue instead as follows:

- As noted earlier, when the 1920s economic boom blew up, it was simply not possible for bankers to be accommodative enough to prevent a very serious recession. At least, it wasn’t possible without drowning the economy is a sea of liquidity, as Bernanke & Co. did 80 years later. Free market economies simply cannot flourish in a government-orchestrated monetary tsunami.

- There were excellent reasons why central bankers, not just in the U.S. but everywhere in the world, weren’t more accommodative following the Crash. Those reasons had to do with the gold standard and the impossibility of simultaneously encouraging economic growth (by lowering interest rates) and avoiding a massive run on a country’s currency and gold reserves. More on this in a bit.

- Deficit spending, if engaged in on a massive scale, might have mitigated the Depression, but there was simply no possibility that government spending on such a scale could have happened. Roosevelt was willing to spend to ease the lot of the unemployed—the CCC and the WPA kept Americans’ spirits up—but even he and his fellow Democrats were opposed to stimulus spending. (In any event, the U.S. government was then very small relative to U.S. GDP.) Eight decades later, the best Obama and the Democrats could do was a $787 billion pork-barrel stimulus that did nothing but increase the Federal debt. (If the Republicans had controlled the White House and both branches of government, they would have been just as bad.) There is no point in blaming policymakers for not doing something that is a fantasy.

- Bernanke is famous for his theory that the failure to prevent the collapse of the banking system in the 1930s prolonged the Depression. When I debated him, Bernanke claimed that “9,000 American banks failed in the early 1930s.” I later checked and he was exactly right—but the statistic is highly misleading. I’ll get to that issue in a moment.

Summarizing the failures and successes of the policymakers of the 1930s, we can clearly see that they should have been more active in trying to control the boom period of the 1920s. They could also have been far more accommodative following the Stock Market Crash. Partly as a result of those “failures”, but mostly as a result of the over-the-top boom of the 1920s, Americans suffered through a long and deep recession.

But policymakers in the 1930s also understood—far better than their modern counterparts—that the “destruction” part of the creative destruction that characterizes modern free market economies is crucial. Without occasional destruction, there can be no creative growth.

I’ll come back to this point later, but first, let’s take a look next week at the role of the gold standard and the banking system in supposedly prolonging the Depression.