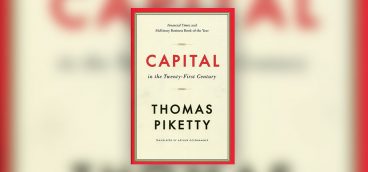

A few years after “Capital in the Twenty-First Century” exploded on the scene, the University of Chicago surveyed 36 well-known economists, asking if they agreed with Piketty. The results? One yes and 35 no’s. How could a book so celebrated upon publication diminish into obscurity in a few short years? Presumably, it had something to do with …